Section Branding

Header Content

Tariffs Could Trigger Job Losses In Northwest Georgia

Primary Content

President Donald Trump promises to bring back factory jobs by cracking down on imported products from Mexico and China. But many worry he will trigger a trade war—and end up wiping out jobs, not creating them. As Jacqui Helbert reports with the Center for Public Integrity, Northwest Georgia could end up one of the biggest losers of all.

Beneath the “Buy American” roadside signs here, a globalist heart beats in this mostly rural corner of Northwest Georgia.

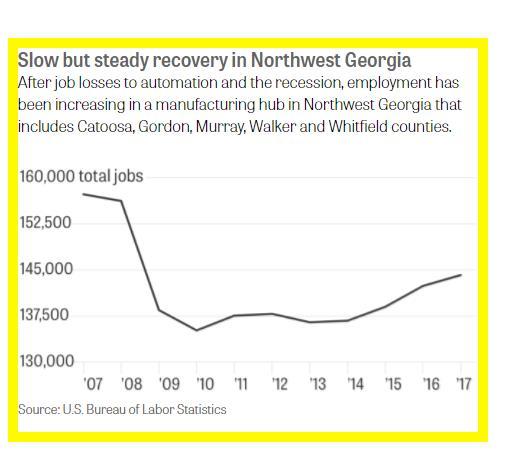

In the late 1980s, factories began eagerly hiring Mexican immigrants to help fuel a boom in the so-called Carpet Capital of the World. Automation and the 2008 recession went on to pare a lot of jobs. But plants of all sizes are back at it again, producing about half the world's carpeting as well as hard-surface flooring, a new signature product. Other shops nestled in the foothills of the Blue Ridge Mountains churn out everything from auto parts and appliances to goods made from chemicals, metal, wood and rubber. A sense of recovery is in the air.

Global investments flow in. Domestic sales and exports flow out. And just as many factories here turned to immigrants for manpower, they’ve also grown accustomed to foreign sources of materials — from Asia, Europe, Latin America — to make flooring and all kinds of other goods.

“If I want to make something with quality,” and an import helps, “I’m going to get it. I have to. I want to make money. That’s the point,” said veteran flooring worker Eduardo Osegueda, part of a migration that's brought the world into Dalton, a city of 34,000 that sits along Interstate 75.

While most of the flooring made here is sold domestically, for housing and commercial space, carpet can also end up installed in vehicles, ships and aircraft bound for export. The Dalton area also directly exports more carpeting than anywhere else in the United States, primarily to Canada and Mexico. There’s no doubt that global trade helps grease the wheels of the economy here.

And therein lies the irony.

Because this is Trump country. In a five-county region surrounding Dalton, three-fourths of voters cast their ballots for the former New York real estate developer. And yet, if the new president follows through on one of his frequent campaign promises — to get tougher with our trading partners — some economists believe that Northwest Georgia wouldn’t become a beneficiary, but a victim.

Big time.

As he crisscrossed the country last fall, Donald Trump stoked populist passions of voters by vilifying other countries, especially Mexico and China, for “stealing our jobs.” He vowed to both boost U.S. exports and “bring back millions of jobs” to the States. He threatened to slap hefty tariffs on imports coming from China and Mexico, two countries that account for a quarter of U.S. international trade. Just in the past month, he’s banged the trade-war drum even harder, starting the process to renegotiate the North American Free Trade Agreement, NAFTA, with Mexico and Canada, and slapping countries with targeted tariffs.

But if Trump were to squeeze Mexico and China as hard as he’s threatened, the resulting disruption in cross-border trade would have an impact all over the country, even for businesses that don’t export themselves. In fact, Northwest Georgia would get hit with some of the worst job losses in the nation, from manufacturing to retail, according to a complex data analysis based on Trump’s threats by the Peterson Institute of International Economics, a nonpartisan Washington, D.C., think tank.

Five of the 12 counties with the largest percentages of private-sector job losses, the institute’s modeling found, would be clustered here in Northwest Georgia, just south of Chattanooga, Tennessee — Catoosa, Gordon, Murray, Walker and Whitfield.

Murray County, population 39,315, would be the No. 1 loser nationally, with a crushing job loss of 18.3 percent in a trade war lasting more than a year. Whitfield, where Dalton is the county seat, would suffer a 12 percent slide in jobs, making it the No. 2 job loser.

“We’re not talking Great Depression, but something as severe as anything experienced since,” said study co-author Marcus Noland, an economist and Peterson vice president.

Winds of trade war?

Peterson’s research didn’t reverberate much beyond wonkish Washington, D.C., upon initial release last fall, but the forecast holds new currency now. Trump has started to hit countries with punishing tariffs — so far, narrow in scope — while aides prepare a broad list of trade terms the president might want to change.

Last month, Trump ordered the Commerce Department to investigate whether steel imports “threaten to impair the national security” — sparking Chinese official media to warn Trump to stick with using existing trade grievance systems or risk a trade war.

Trump also hit Canada with a new tariff of as much as 24 percent on softwood lumber imports. The president then sent shockwaves through Congress with a signal that he was poised to withdraw from the tariff-lowering North American Free Trade Agreement, NAFTA, with Mexico and Canada — only to suspend the threat hours later.

As a candidate, Trump made specific threats to hit Mexico and China with 35 and 45 percent import tariffs across the board. Trump — who has manufactured products in both countries — argued that stiff tariffs would drive up import prices, forcing U.S. companies to bring back factory work, and compel Mexico and China to acquiesce to trade reforms he’d want.

But Peterson’s researchers argue that it’s “fully plausible” that China and Mexico would react by slapping reciprocal tariffs on U.S. products. A trade war would ensue, and if it persists more than a year, the institute’s model showed, 29 American counties would suffer job losses of 7 percent or more — and 20 states would suffer job declines of more than 4 percent.

“The U.S. economy is deeply integrated into the global economy, and to try to unwind that globalization would be enormously disruptive,” Noland said.

Even if Trump were not to resort to such dramatic tariffs, the Peterson findings suggest that other broad protectionist trade proposals now in Washington come with risks.

Republican leaders in the House of Representatives, for example, are proposing a so-called border adjustment tax of 20 percent on all imports from all countries. Businesses are split on the proposal. Supporters contend the border tax is vital — it could offset lost revenue from big corporate tax cuts the GOP wants. Republican House leaders also want to eliminate taxes on exports, arguing that businesses will invest those savings domestically to create jobs.

Trump hasn’t endorsed the border tax, but he hasn’t ruled it out. And tariffs remain on the table.

“We’re getting killed. We’re losing all of our jobs. We’re losing everything,” Trump complained before the election. “Trade war? … Who the hell cares if there’s a trade war?”

Peterson’s top researchers, most of whom have government trade policy experience, used their forecast to criticize U.S. failure to support retraining for workers displaced by manufacturing job losses. But the institute — funded by business giants that include Aetna Inc. and Dow Chemical Co. — generally produces pro-free trade research that clashes with Trump’s rhetoric. One of Trump’s closest trade advisers, White House Trade Director Peter Navarro, during the election campaign labeled Peterson’s economists “the pimps of globalization,” who “weave a false narrative.”

The White House did not respond to requests to interview Navarro. The former economics professor from the University of California at Irvine is known for hardline skepticism of the current global trade system. In March, he conceded before the National Association of Business Economists that a trade shake-up aimed at bringing back factory work would come with “difficulties and bottlenecks and labor issues.”

“But that doesn’t mean we shouldn’t try,” he said.

In Dalton, workers like 25-year-old Jaime Rangel have a stake in the outcome.

“It’s going to be wait-and-see with President Trump,” said Rangel, who until recently drove a forklift at Beaulieu, a prominent local wall-to-wall carpet and hard-surface tile manufacturer. He’s now working toward a degree in finance and economics at Dalton State University and hopes Trump makes “smart decisions.”

“The entry-level jobs, we don’t really know a lot about international trade,” Rangel said. “People might see a headline on Univision or CNN.”

But people remember the recession. “It was a terrible time for our community,” he said. “My parents lost their house.”

Global kings of flooring

The origins of manufacturing here stretch back to the late 1800s, when a Dalton seamstress’ bedspreads morphed into mass production of carpets, and blue-collar work grew plentiful. Befitting Dalton's carpet industry legacy, the global kings of floor manufacturing are headquartered in the area, where they produce goods and direct worldwide operations.

There’s Gordon County-based Mohawk Industries Inc., a Fortune 500 company that identifies itself as the biggest flooring company in the world, and the largest supplier of aircraft carpet. It owns multiple soft carpet lines, Pergo and other hard-surface brands, and ceramic factories in the United States, Mexico and other countries. Mohawk reported a record $9 billion in sales last year, 35 percent outside the United States. Mohawk has operations scattered from Mexico and Brazil to Russia and Malaysia that can directly serve those markets. In its 2016 annual report, Mohawk said its foreign sales and operations are subject to risks of “foreign tariffs and other trade barriers.”

Also here: longtime Dalton fixture Shaw Industries Group Inc., a subsidiary of Warren Buffett’s Berkshire Hathaway Inc. Shaw claims current annual sales of $4 billion. In 2013, it opened a carpet factory in China to serve the Asia market and said it would use yarn from U.S. operations. Shaw also opened a new plant south of Dalton in 2016 that could eventually employ 500 people to produce carpet squares. It also converted a carpet plant in Catoosa County to create homegrown, trendy luxury vinyl flooring tile.

Just across the Dalton Bypass from Mohawk is Engineered Floors LLC, a newcomer founded by Robert Shaw, former head of Shaw Industries. The company has built massive factories in the area in the last several years and acquired other U.S. companies that specialize in hard flooring.

Mohawk, Shaw and Engineered Floors turned down repeated requests to discuss proposed White House and congressional trade policies — policies that could disrupt the flow of imports they are using, especially for hard flooring.

Just several miles north of some company plants, up Abutment Road, is a quaint red-brick building in downtown Dalton’s historic district. Inside is the office of the Carpet and Rug Institute, a trade association whose members include Mohawk, Shaw and Engineered Floors.

Joe Yarbrough, president of the institute, said he only speaks for the carpet industry, but not for the hard-flooring side of the business that’s become such a white-hot market. He downplayed the carpet factories' need for imports because most of the essential material is locally supplied. Exports are important, he also said, but they pale in comparison to domestic sales. The association estimates the carpet industry generates $8 billion in regional “business activity.”

In 2015, Murray and Whitfield counties alone exported carpets and related non-apparel textiles valued at $298 million, mostly to Canada and Mexico. That’s far more dollar value than from anywhere else in the United States, based on U.S. Department of Commerce trade data. The New York metro area was a distant second at $171 million. Other factories in Murray and Whitfield counties exported almost $154 million in machinery and goods crafted from chemicals, plastics and rubber that year.

Yarbrough listened to a summary of Peterson’s findings. “Well, I can’t predict the future,” he said. No one wants to lose business, including exports, he said. But manufacturers are more excited about tax cuts and deregulation prospects than any other Trump trade promises. Tax cuts, he said, would be more of a “positive way to give relief than a 20 percent border tax.”

Job losses in Trump Country

Recent history here is a tale of bust and then boom. Steadily, as in other factories, technology has chipped away at less-skilled textile jobs. And when the housing market — and demand for carpets — collapsed in 2008 during the national financial housing crisis, the Dalton area hemorrhaged thousands more jobs.

Between June 2011 and 2012, more than 4,600 jobs evaporated in Murray and Whitfield counties, leaving them with a combined 12 percent unemployment rate. The plunge was the greatest 12-month decline in jobs in any metro area in the country at that time.

Times were so bleak that in 2014 the Obama administration chose Northwest Georgia as one of the first dozen regions in the nation to get a slice of $1.3 billion in federal spending designed to revive manufacturing. Northwest Georgia’s plan was to support a private-public partnership that’s continued to train students and others in “sustainable” flooring jobs as the industry changes.

As the national economy improved, innovation and billions of dollars in corporate investment have added back thousands of jobs. A United Arab Emirates firm, Mattex, for example, invested $60 million in Murray County to open a factory to produce backing for carpets and artificial turf. The state of Georgia has been luring businesses to the state with tax breaks, and relatively low labor costs. As of December 2016, the five counties reported jobless rates of between 4.5 percent and 7 percent — a big reduction from rates as high as 12 percent to 14 percent just six years ago.

It all sounds good. But based on Peterson's findings, a trade war with partners the size of Mexico and China could push Northwest Georgia back into an even deeper economic abyss than the last recession.

Noland explained why.

Economists used traditional equations to measure how tariffs would affect exports and imports nationally, and depress levels of consumption and investment. With significant tariffs, import-price surges would also lead to inflation and stock market declines. Businesses that produce “capital goods,” goods used to manufacture other goods, like textile machines, would struggle to adjust. Economists applied the fallout to job and industry patterns at the state and county level.

“For a sector to be hit,” Noland said, “it does not have to export directly if its product is used intensively in the production of exports.”

Northwest Georgia would suffer for multiple reasons. Manufacturing would get hit from a fall in demand for carpeting and other goods that go into construction, auto production and other goods. A decline in export markets and imports would hurt earnings and production costs. In addition, rising prices for cheap imported consumer goods would hit retailers — think Walmart and BestBuy — and restaurants, food and beverage stores and even hospitals would bleed jobs as fewer residents would be able to buy products and services.

“Most Americans don’t work in jobs that they would associate with international trade, much less exports,” Noland said, “so most Americans probably don’t think they have a dog in this fight. The thing that was most surprising to us was just how untrue that was.”

Sparsely populated areas anchored by industries sensitive to trade upheaval — as Northwest Georgia is — would also suffer disproportionately because they’re less capable than economically diversified urban areas of absorbing laid off workers.

Down at the five-county level, Peterson’s model predicted that textile plants from yarn to rugs and other manufacturing would lose jobs. But trucking, warehousing and other services that employ fewer people than factories would lose just as large a percentage of jobs, or even more by proportion than factories.

Take Murray County, just west of Dalton. Peterson’s forecast found a trade war could lead to a 5 percent job loss in carpet and rug plants and a 41 percent job loss in synthetic rubber work. That would contribute to an 83 percent job loss in employment agencies and a 71 percent job loss in food and beverage businesses.

The Peterson model didn’t factor in losses to public-sector jobs. And predictions of job losses are likely conservative in some areas, Noland said, because economists didn’t have access to proprietary information about specific imported “supply chain” goods that are critical to certain localities. Supply chain goods are pieces and parts that go into making a finished product.

On a forested hilltop campus, Dalton State College economics professor Robert Culp agreed to opine on the Peterson study. He teaches at the business school and is keyed into Northwest Georgia’s local industries.

Culp said he couldn’t argue with the Peterson findings. A trade war “could be very detrimental to our economy,” he said.

But he is not sure Trump is serious about carrying through on the threat of tariffs.

“It could be just a negotiating point, right?” Culp offered. “That’s what Trump is famous for, right? ‘The Art of the Deal’? I hope that’s what he’s trying to do here.”

Dalton business professor Marilyn Helms teaches students about supply chains. She agreed that carpet factories benefit from a robust local supply chain. But a stifling of cross-border trade would hurt, including Dalton’s exports of textile-related machinery and other specialty goods.

“We’re lucky to keep a textile industry here,” Helms added.

Split on the factory floor

Even though the local Dalton economy [FS1] improved during the past few years, Trump’s bleak assessment of job conditions nationwide resonated here, along with claims that his business acumen would create more factory jobs.

Candidate Trump’s promises to tackle trade deals made sense to Matthew Barnes at the Chilewich textile factory, on Highway 225, near Chatsworth, Georgia, population 4,300. About 75 workers use vinyl to weave chic modern placemats, floor and wall coverings, tote bags and ottomans for the high-end market. Much of the material used is purchased in the United States, Barnes said.

“I think that definitely you have to have good relationships with the other countries,” said Barnes, who manages daily operations at the plant. “But to get those relationships, we let them walk all over us — sometimes. And you’ve got to put your foot down every once in a while.”

Inside the Chilewich plant, boxes of textiles ready for shipping line shelves. Machine arms swing, guided by employees, weaving, slicing and rolling out the luxury vinyl designs. Barnes is pleased that over a dozen years Chilewich's sales have soared — even through the recession — and that the company exports about 30 percent of its products, mostly to Europe, but also to Mexico and other foreign destinations.

“We have distributors all over the world,” Barnes said. “One of the things I’ve heard about our customers is that they love that this stuff is manufactured in the U.S.”

But New York City-based co-owners Joe Sultan and his wife Sandy Chilewich, the company’s chief designer, weren’t Trump supporters. They’re skeptical of Trump's pitches for strengthening manufacturing and worried about Congress' proposed trade policies, too.

Sultan strongly believes the United States needs to bolster its manufacturing. But the notion of wielding punishing tariffs against trade partners or border taxes strikes him as perilous. The European Union is already signaling that it would put up protectionist barriers if the United States does, Sultan said.

“I think based on what the Republican House is talking about there very easily could be a tit-for-tat trade war. You know, if they do the 20 percent import tax. I think it’s dangerous,” Sultan said. “I don’t think they understand how complex this can be, and I think it’s going to just grind everything to a halt.”

In Dalton, Swiss immigrants Andreas Bruhwiler and his wife Daniela run Alrol of America, which employs a handful of employees to make metal rollers coated in rubber that are used in the manufacturing of carpets, plastic bags, garage doors and other products.

Bruhwiler doesn’t export his products directly very often. But he knows that once he sells them, some of Alrol’s rollers eventually end up in machinery in China, Mexico, Canada and other countries. Bruhwiler said he was reluctant to comment on Trump’s trade policies because he considers himself a guest in the United States, but he did say, “I think a free-and-open market is important not only for our reasons, but for our economy in the United States.”

When asked if a tariff would affect Alrol, Bruhwiler said he would be concerned about the price of one key product that he imports.

"It would be very difficult for us," he said, “because of the [price advantage] we have on that particular part.”

Georgia’s foreign supply lines

It’s hard to calculate precisely the kinds of imports flowing into Dalton and the surrounding counties. The U.S. Department of Commerce doesn’t track imports in such granular detail.

But Georgia has long courted trade with Mexico, China and other countries, posting representatives abroad to nurture exports and imports. Last year, the value of Georgia’s two-way trade with the world surpassed $121 billion, an increase of 45 percent since 2008, based on Georgia state officials’ tracking.

By its own count, Georgia is the 11th-largest exporting and 7th-largest importing state nationwide. Canada, Mexico and China top the list of countries receiving Georgia’s exports. China, Germany and Mexico lead the list of countries that send goods into the state.

“With the world's busiest passenger airport and North America's fastest-growing port [Savannah] located here, any business can be assured that its supply lines will never run dry in Georgia,” Georgia Gov. Nathan Deal, a Republican, wrote in a 2015 commentary published by CNBC.

To adapt to American consumers’ growing taste for hard flooring, some of the big Northwest Georgia firms are investing in new plants to produce essential materials at home. But it’s a certainty the flooring companies import a lot, said Reginald Tucker, managing editor of Floor Covering News, a trade publication. Planks of wood-like, ceramic and luxury vinyl flooring, which are fast winning consumers’ hearts, often contain multiple foreign components, he said.

“It’s akin to automobile manufacturing,” Tucker said. “Even the large manufacturers import some of their raw materials. It’s just easier to do than to build a whole new plant.”

And all of that could be subject to new taxes or tariffs at the border, increasing costs.

The United States can’t grow prized exotic wood, cork or enough bamboo, Tucker said. And it’s common for U.S. factories to create finished planks out of layers purchased from suppliers on other continents.

Northwest Georgia companies have a history of brisk importation of special materials, from components for carpets to hard-surface flooring, based on shipment data gathered by Panjiva, a private company that tracks companies involved in global trade.

In individual shipments that can weigh up to hundreds of thousands of pounds each, a stream of imported cork sheets, bamboo and other wood veneer planks, vinyl sheets, ceramic, stone and assembled parts have flowed into Georgia flooring companies or affiliates over the last decade.

In April alone, USFloors — a Dalton-based company Shaw bought last year — imported nearly 100 shipments weighing more than 14 million pounds signed for in Dalton, according to Panjiva data. Among individual shipments going into Georgia’s Port of Savannah were 186,000 pounds of vinyl flooring, 48,500 pounds of bamboo materials and more than 251,000 pounds of “engineered vinyl flooring.”

In May, Mohawk Industries received, among other shipments, more than 169,000 pounds of vinyl floor tile from China, 108,000 pounds of “hickory engineered flooring” from Vietnam, and more than 100,000 pounds of glazed ceramic tiles from Ecuador. In January and February, Mohawk also received about 740,000 pounds of carpet underlay assembled in Mexico from U.S. parts. Some economists estimate that for every dollar’s worth of a Mexican import, 40 cents of its value originated with U.S. products.

The possibility of disrupting this business doesn’t instill panic yet in Dalton. It’s a sentiment that can be summed by Jenna King, a young mother who worked in the local mills after graduating high school. Now a student at Dalton State College where she is studying human resources management, King said she understands manufacturing employment can be volatile. Her husband was laid off his factory job during the last recession. But she still hopes to land a job with a local flooring manufacturer.

King, who was taking a break in a lounge at the business school, listened to a summary of Peterson’s conclusions: that a big squeeze on imports could kill jobs here rather than create them.

“That’s a legitimate worry,” King said. “But the American people always have ways to bounce back, whether it’s with carpet or technologies. I believe in our government. I think they would be able to do what’s best for the people.”

Flooring worker Osegueda, who emigrated long ago from Mexico, said that when Trump complains about imports, he can’t help but think about Cuba, and how the communist country suffered from the U.S. trade embargo and Cuba’s own restrictions on foreign commerce.

“If he closes the doors to everybody else, to their products coming into the United States, I guess we're going to have to figure out how to make our own money here,” Osegueda said of Trump. But, he added, “I don’t know how we're going to do that, actually.”

For more on the investigation and to check out trade war maps and job loss charts, click here.