Section Branding

Header Content

Biden reappoints Jerome Powell as Fed chairman at a critical time for the economy

Primary Content

President Biden has chosen to keep Jerome Powell in place for a second term as Federal Reserve chairman — a move that signals continuity with the central bank's policies at a time when the economy faces critical challenges, including surging inflation

Biden nominated current Fed governor Lael Brainard to serve as vice chair. Brainard had been seen as a leading contender to replace Powell.

Under Powell and Brainard the Fed has kept interest rates near zero despite the current high prices for all kinds of goods, as it focuses on returning the economy to full employment and as policymakers argue that inflation will prove temporary.

"Powell and Brainard share the Administration's focus on ensuring that economic growth broadly benefits all workers," the White House said in a statement.

Biden's pick to stick with Powell will likely reassure financial markets, despite opposition from some progressive members of the president's own party.

Powell, a Republican, was originally appointed to the Fed's governing board by former President Barack Obama and was elevated to the chairman's post by then-President Donald Trump.

As chairman, Powell has steered the central bank's aggressive response to the economic upheaval caused by the pandemic, slashing interest rates to near zero and quickly launching a series of emergency lending programs.

Powell also oversaw a new Fed policy that directs the central bank to be patient in raising interest rates in hopes of fostering more widespread job growth.

That policy was adopted in 2020 after years in which inflation fell short of the Fed's 2% target, but it's now being tested as prices have surged, pushing inflation to a 31-year high.

The Labor Department says prices in October were 6.2% higher than a year ago, the sharpest increase since 1990.

Powell and his colleagues believe today's price hikes are largely the result of temporary factors tied to the pandemic, which should ease on their own as the health outlook improves. It's a view that's been challenged by some economists and prominent Democrats such as former U.S. Treasury Secretary Larry Summers.

The central bank has to weigh the risk of tolerating higher inflation against the cost of choking off job growth with higher interest rates at a time when millions of people are still out of work.

"It's extremely important that we get that right," Powell said recently at a conference sponsored by the South African Reserve Bank. "I am confident that we will do so over the course of the next year or so. I think in the meantime, it's going to be extremely challenging, certainly in the short term."

Powell has faced opposition from progressives

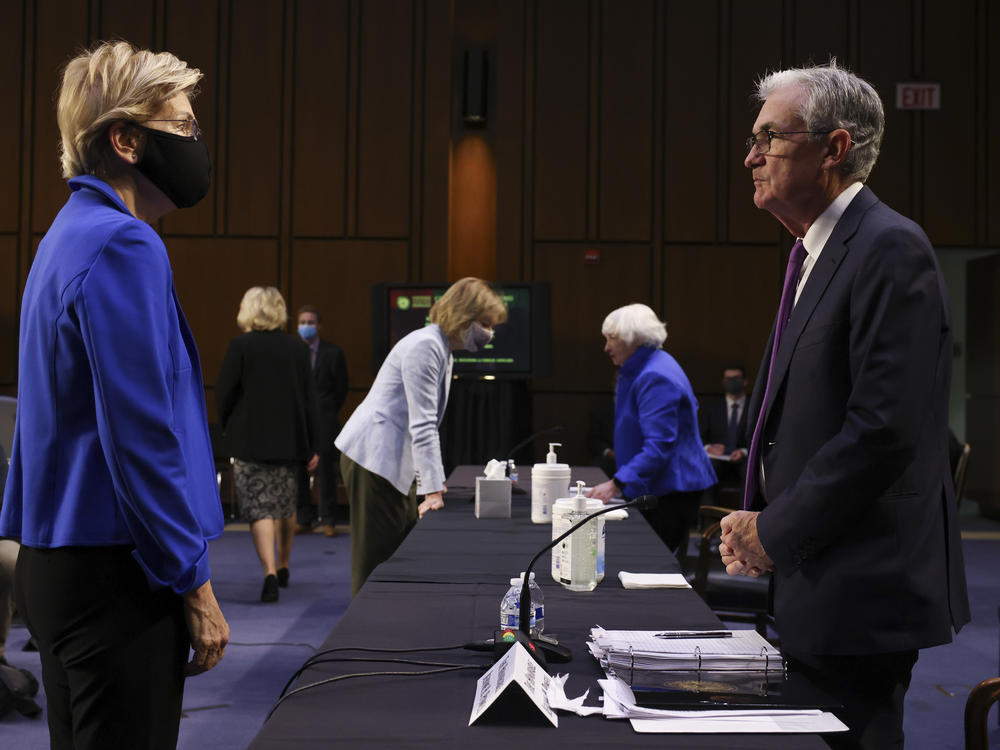

Progressive critics, including Sen. Elizabeth Warren, D-Mass., have accused Powell of watering down bank regulations adopted in the aftermath of the financial crisis. At a recent Senate Banking Committee hearing, Warren described Powell as "a dangerous man."

That criticism failed to get much traction, though. The co-sponsors of the Dodd-Frank law behind those bank regulations, former Sen. Chris Dodd, D-Conn., and former Rep. Barney Frank, D-Mass., have defended Powell and said he deserves a second term.

Powell has also had to navigate an ethics controversy after reports this fall that two former presidents of regional Federal Reserve banks actively traded stocks and other securities last year, at a time when the central bank was heavily involved in financial markets.

Former Dallas Fed President Robert Kaplan and former Boston Fed President Eric Rosengren retired last month after the trades came to light. Both men have denied any wrongdoing, but Kaplan acknowledged that the controversy could be a distraction for the central bank. Rosen said he was stepping down for health reasons.

The Fed's inspector general is reviewing the two men's trades, which appear to be in compliance with the central bank's rules at the time. The Fed has since adopted stricter rules that limit the trading of individual stocks and bonds and require disclosure of any trades within 30 days.

"We have to have the complete trust of the American people that we're working in their interest all the time," Powell said in describing the new rules.

In nominating Powell for a second term, Biden is observing a tradition that Fed chairs typically don't change, even when the party in control of the White House does. That's one way to safeguard the central bank's political independence. Trump broke with that tradition when he replaced then-Fed Chair Janet Yellen, a Democrat who is now Treasury secretary, with Powell four years ago.

Powell's nomination is subject to confirmation in the Senate, where he is expected to get broad, bipartisan support.

Copyright 2021 NPR. To see more, visit https://www.npr.org.