Section Branding

Header Content

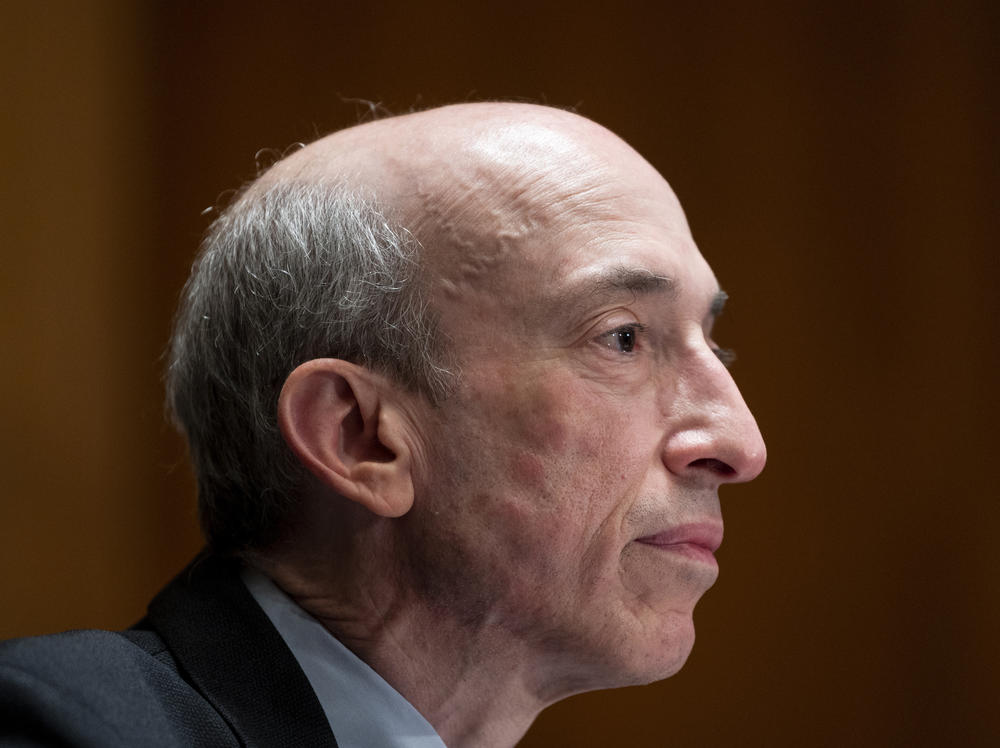

SEC Chair Gary Gensler says tougher rules for hot, buzzy SPACs are coming soon

Primary Content

Gary Gensler, the country's top securities regulator, said he's aiming to announce tougher rules for SPACs by early next year, as he warned about the potential dangers of the hot investment craze sweeping through Wall Street.

Gensler's comments, in an interview with NPR, come as the U.S. Securities and Exchange Commission is already adopting a tougher approach to SPACs, including investigating a deal made by former President Trump's social media company.

SPACs are shell companies — or "blank check companies" in Wall Street lingo — that list on exchanges with one objective: to find a private company to merge with. That provides the targeted company with a faster and less onerous way to achieve a listing than the traditional initial public offering (IPO) route.

Gensler said the tougher rules would aim to enhance investor protections by focusing on the disclosures made by SPACs, by examining how the companies market themselves, and by ensuring banks hired by SPACs are "digging deeper" and providing the appropriate level of scrutiny.

"I think we hopefully will propose something, subject to my fellow commissioners' views, in the early part of next year," Gensler said.

The SEC has already stepped up scrutiny of SPACs, which became a popular way for companies to list in markets this year during a record-setting rally.

On Monday, a SPAC called Digital World Acquisition Corp. (DWAC) that is planning to merge with former President Trump's social media venture said it was under investigation by regulators, including the SEC.

And separately on Monday, Lucid Motors said it has received a subpoena from the SEC requesting documents. The buzzy electric vehicle maker listed earlier this year after merging with a SPAC.

Gensler declined to discuss specific companies in the interview.

Why SPACs worry regulators

Regulators have worried that SPACs are attracting average investors who don't fully understand the risks. The investment trend has been so hot that many celebrities have gotten involved, including Jay-Z and Shaquille O'Neal.

Traditionally, private companies have used IPOs to raise money. But that process can take a long time and requires extensive vetting.

SPAC mergers have become a popular way to circumvent that. But they have made regulators skittish, with Gensler frequently arguing there shouldn't be two sets of standards — one for traditional IPOs, and another for SPAC mergers.

Another criticism of SPAC mergers is they disproportionately favor the team that started the shell company, known as the SPAC's "sponsors," who have key advantages over regular investors.

"All the financial studies have shown that the real winners in the SPAC regime are the sponsors," says James D. Cox, the Brainerd Currie Professor of Law at Duke University, who has been studying the SEC for almost 50 years. "It's long overdue for taking a hard look at SPACs."

Gensler, a longtime regulator who previously headed the Commodity Futures Trading Commission, has promised a tougher approach to Wall Street since President Biden appointed him to head the SEC.

Most prominently, the SEC is also looking at tougher rules for cryptocurrencies including Bitcoin.

In the interview, Gensler summarized his job simply.

"I just want to take every day to see what we can do for the American public, for young investors, for working families, for retirees," he said. "And then, hopefully, make the markets a little better for regular folks."

Copyright 2021 NPR. To see more, visit https://www.npr.org.