Section Branding

Header Content

Stocks around the world were hit hard by omicron fears. Here are 3 things to know

Primary Content

Updated December 20, 2021 at 8:01 PM ET

Wall Street tumbled on Monday over fears about the omicron variant, which is spreading around the world in the midst of the busy holiday season.

The Dow Jones Industrial Average closed down 1.2%, or 433 points. The Nasdaq and the S&P 500 also fell by more than 1% each. Other exchanges around the world tumbled as well on Monday.

Investors worry about the impact from omicron at a time when the global economy is still recovering from the impact of the pandemic.

Omicron is now the dominant strain of the coronavirus in the U.S., accounting for the bulk of new infections.

Here are three things to know about how omicron could hit stocks.

So what's happening in markets?

Though most people are not yet sounding the alarm bells, worries are certainly increasing.

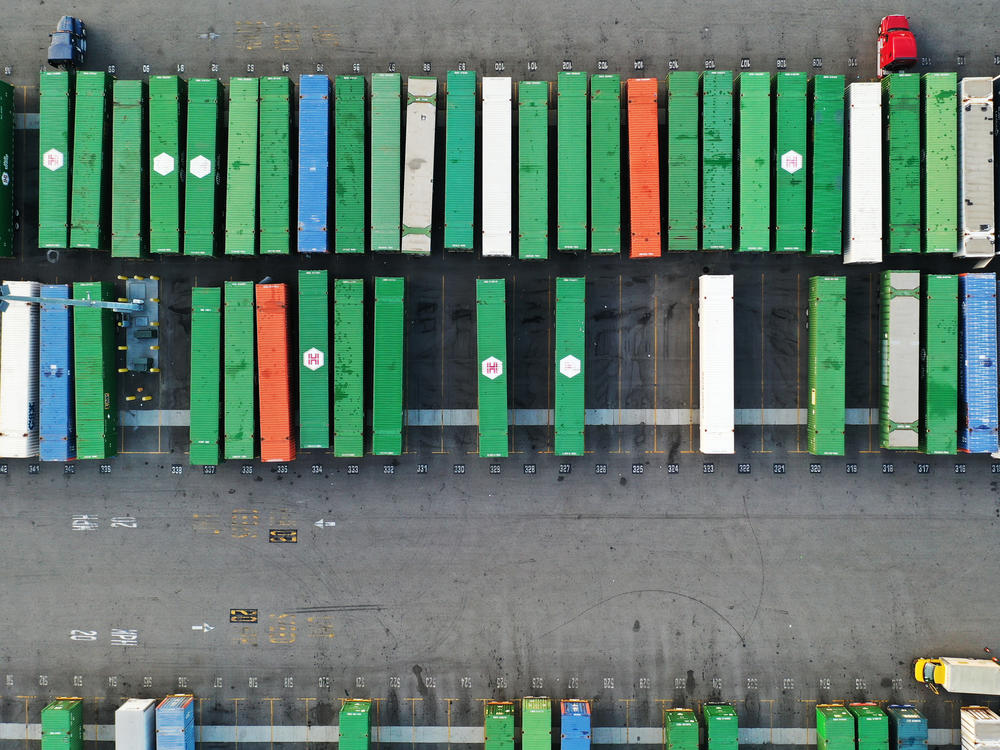

More immediately, investors fear the impact from new restrictions being imposed around the world, which have the potential to shut down global travel and exacerbate the supply chain constraints around the world.

Over the weekend, the Netherlands imposed a lockdown, and other countries are imposing or considering restrictions on social gatherings and on travel.

The World Economic Forum announced plans to postpone its annual gathering of heads of state and high-profile executives in Davos, Switzerland. Over the weekend, organizers cancelled concerts and sporting events.

These restrictions could potentially hit spending around the world especially during this holiday period when more people were planning to gather and travel after vaccines had been widely rolled out.

Another big fear is how it impacts the global supply chain. Previous outbreaks of COVID-19 have shut factories in China and the Philippines among other countries and made the transport of goods even more difficult.

How bad could it get?

Investors acknowledge there is a lot they don't know. Scientists first identified the variant only a few weeks ago.

"The biggest concern that markets have is that no one seems to have an edge on the path forward," says Eric Freedman, the chief investment officer in the asset management group at U.S. Bank.

Of course, Wall Street has seen other COVID-19 variants such as Delta emerge. In the past, when that has happened, it rattled markets, but downturns tended to be short-lived.

So markets have proven to be remarkably resilient, and even after Monday's selloff, the major U.S. indexes are still close to record levels.

Of course, much will depend on the progress of omicron, and how businesses and governments react.

Omicron is also spreading in what is traditionally a quiet period in Wall Street. That means fewer people are trading, which tends to magnify any moves.

Chances are investors will remain cautious as the end of the year approaches.

How will this affect things going forward?

The bottom line is this new variant has added another layer of uncertainty to a market that already has been dealing with uncertainty about the year ahead.

Inflation continues to be a huge concern. As the global economy has reopened, prices have climbed higher than many policymakers expected.

Many of the world's largest central banks, including the Federal Reserve, have begun to scale back some of the programs and policies they put in place during the pandemic, to prop up markets and the economy.

The Fed, which has kept interest rates near zero for a long time, has signaled it could raise them three times in 2022. Higher interest rates mean higher borrowing costs for companies and consumers, and investors continue to game out what that could mean.

Because the Fed and other central bank did so much during the first part of the pandemic, Savita Subramanian, the head of U.S. equity and derivatives strategy at Bank of America, wonders how they would respond if omicron leads to another downturn.

"The question is how much money can we throw at the problem at this point?" she says.

There are other uncertainties. There is still considerable debate about the U.S. jobs market. Many businesses such as restaurants continue to struggle to find workers, and those challenges could make that harder if people fear they could get sick.

Copyright 2021 NPR. To see more, visit https://www.npr.org.