Section Branding

Header Content

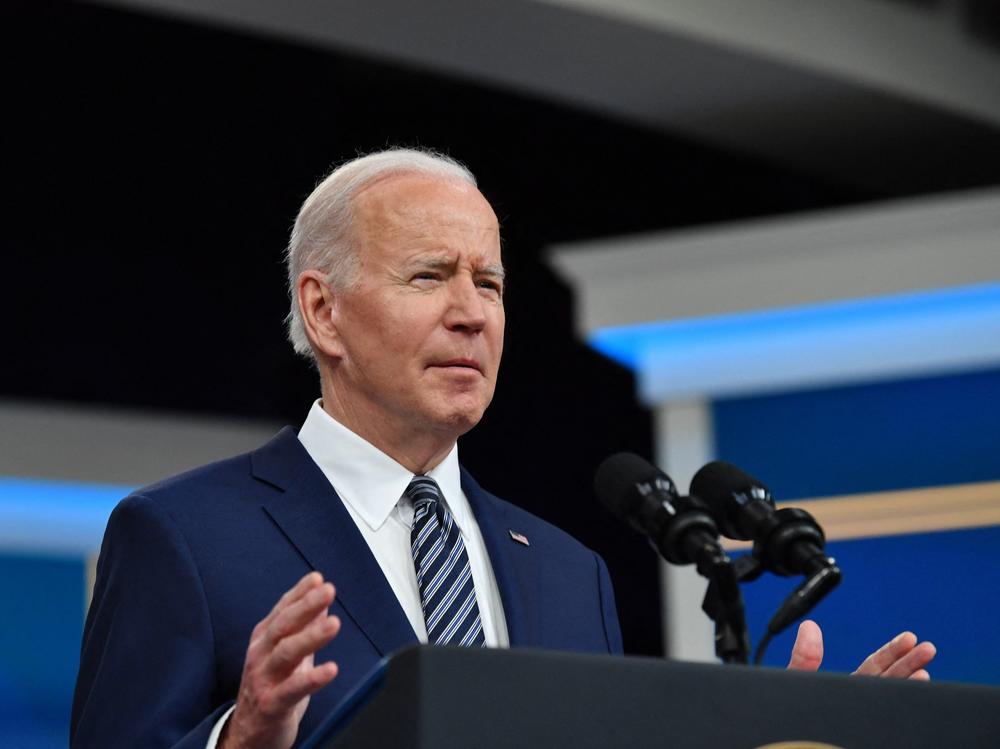

What to know about the U.S. emergency oil stash as Biden gears up to tap the reserves

Primary Content

President Biden is planning the largest-ever release from its emergency oil stash as the U.S. reels from a surge in gasoline prices

The president announced on Thursday a plan to draw 1 million barrels of oil per day for the next sixth months from the country's Strategic Petroleum Reserve (SPR) – for a total of up to 180 million barrels.

The move comes after Russia's invasion of Ukraine had sent crude prices surging, leading to sharply higher gas prices.

The administration had previously announced last year it was releasing 50 million of barrels, and the White House said earlier this year it would release an additional 30 million barrels – moves that had only temporary impacts on climbing oil prices.

Here's an explainer on the country's oil reserves.

What is the Strategic Petroleum Reserve?

It's a stockpile of crude oil that the U.S. maintains in case of emergency. If supplies are disrupted, such as by a hurricane or a war, the U.S. can tap the reserve and avoid catastrophic shortages.

The SPR was established after the oil crisis of the 1970s. The oil is stored in underground salt caverns in Texas and Louisiana. The caverns currently hold more than 500 million barrels of oil, less than one month's worth of oil at current U.S. consumption levels.

In addition to being tapped for emergencies, the oil in the reserve can also be loaned out to oil companies (which repay it with interest), or sold off to raise money for the federal government.

Congress has already ordered the release of tens of millions of barrels over the next few years for nonemergency reasons.

Why is Biden again tapping the SPR?

Simply put, because it's currently one of the few tools the president has to push oil prices down.

Crude prices surged to their highest since 2008 earlier this month, sending the national average for gasoline prices above $4 a gallon.

And rising energy prices, including natural gas and coal as well as oil, are a major contributor to high inflation.

That has left the Biden White House under intense pressure to do something to address high prices, especially ahead of the midterm elections.

After all, history has shown that surging gas and food prices can take a heavy political toll.

How much impact would this SPR release actually have?

It's hard to say how much it would help bring down crude prices, and hence, gasoline prices (although clearly a release of up to 180 million barrels would have a bigger impact than the most two recent U.S. releases totaling 80 million barrels).

Russia's invasion of Ukraine has upended oil markets. The U.S. has banned oil imports from Russia, but the European Union has not.

Nonetheless, financial sanctions and wariness to buy Russian oil have led to a decrease in exports from the country that won't be made up by the U.S. release alone.

The International Energy Agency (IEA) estimated earlier this month that Russia could face cuts of about 3 million barrels per day in its oil exports starting in April. Russia used to export around 8 million barrels per day.

Other oil producers aren't stepping up. OPEC and allies including Russia on Thursday decided to keep to its previous plan of increasing output only gradually, despite pressure from the U.S. to do more.

Meanwhile, U.S. oil producers — under pressure from their own investors — have also not increased production by as much as they typically do when prices are this high.

Copyright 2022 NPR. To see more, visit https://www.npr.org.