Section Branding

Header Content

War in Ukraine is driving demand for Africa's natural gas. That's controversial

Primary Content

As Europe scrambles to replace the Russian natural gas that funds Moscow's war effort, fossil fuel companies are using this moment to push for new gas projects all over the world. Much of the industry lobbying centers on almost a dozen countries in sub-Saharan Africa.

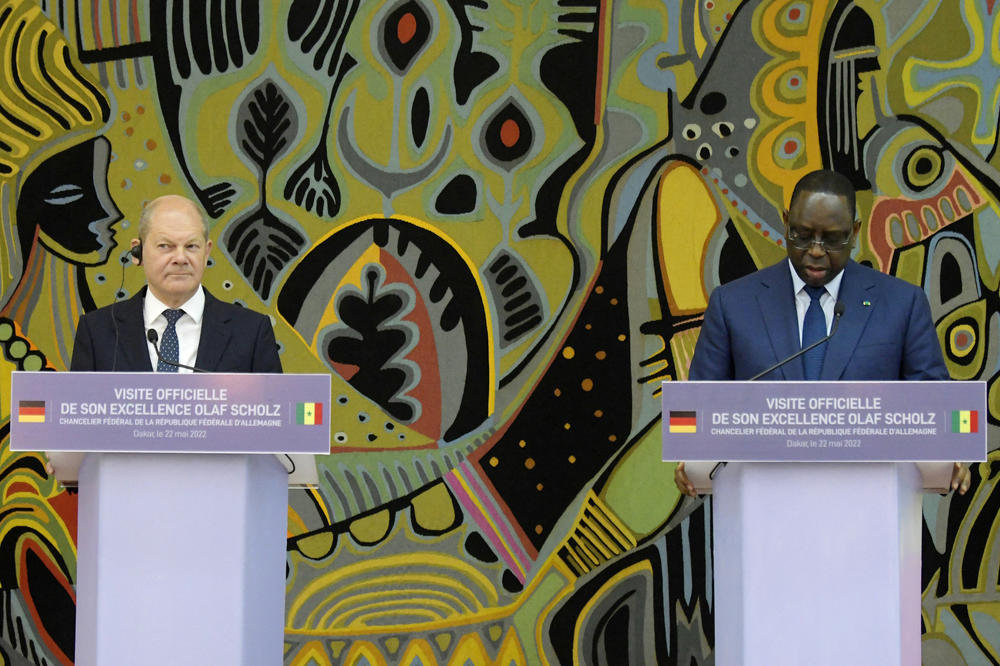

The European Union's new blueprint for getting the bloc off Russian gas highlights sub-Saharan Africa for "untapped LNG potential," referring to liquified natural gas which is imported by ship. This spring the Italian foreign minister visited Angola and the Congo to sign new LNG deals, and the German Chancellor traveled to Senegal for gas talks last month.

American and European energy executives have been landing in private jets across Africa, to persuade governments to accelerate projects they say would feed Europe's desperate demand for gas.

One of those energy companies is Italy's ENI, which is fast-tracking plans for LNG in Congo, and has signed new gas contracts there and in Angola since Russia invaded Ukraine.

"We have of course accelerated deals there in the last month," says Guido Brusco, ENI's chief operating officer natural resources. "Clearly the crisis gave a priority lane."

But there are growing questions over whether many of the emerging multibillion-dollar LNG investments make sense for African nations, says Silas Olan'g, Africa co-director of the Natural Resources Governance Institute, an organization focused on extractive industries.

While some projects will come online in the next few years, several will take closer to a decade, says Roderick Bruce, associate director at S&P Global Commodity Insights. And they are being pushed forward at a time when climate science says most fossil fuel reserves must remain in the ground, unused, so the world can rein in greenhouse gas emissions and avoid the worst catastrophes of climate change. Sub-Saharan Africa is already highly vulnerable to extreme weather.

Olan'g says the gas industry is seeing windfalls now during the Ukraine war. But given the need to address the climate crisis and growth of renewable energy, he worries many fossil fuel companies might be giving African governments hope for future demand that may not exist.

"It's difficult to predict how long this opportunity will be there, especially in the context of the energy transition, the world moving away from the fossil fuels," Olan'g says, "I think they are kind of misleading most of the governments."

Can gas bring about a "just transition" for Africa?

As many countries moved away from coal to generate electricity, they have turned to natural gas, which emits less carbon dioxide, as a so-called "bridge fuel" to the eventual use of renewables. But gas is mostly methane, a potent planet-warming pollutant, and a large body of research shows that it, too, is driving climate change.

In its latest report, the United Nations Intergovernmental Panel on Climate Change said that extracting new fossil fuels - including gas - is incompatible with the goal of limiting global warming to 1.5 degrees Celsius. At the United Nations climate summit in November, dozens of countries, including the US, agreed to stop new public financing for international fossil fuel projects by the end of this year.

But for some African countries, exploiting their huge gas reserves is part of the "just transition", says Olatunde Okeowo, senior associate at energy consultancy RMI. He says that means using hydrocarbon revenues to fuel economic development and an eventual switch to renewable energy.

"Currently, the United States is one of the largest gas producers globally," Okeowo says, "So if there's still going to be some gas demand, should it be a country that has made the most significant contribution to climate change that's producing that gas? Or should it be another country that hasn't had as much of an impact on the climate?"

The "just transition" is something that Mike Anderson, senior vice president at Dallas-based Kosmos Energy, has been talking about a lot lately with African leaders. He recently traveled to Senegal and Mauritania to talk with their respective presidents about offshore LNG projects that could serve Europe as early as next year, and continue producing through the late 2040s.

"If I was an African president in many of these countries being lectured to, 'you're not allowed to use your hydrocarbon resources in any way.' We have! And we in the North have made fabulous amounts of money," Anderson says, "That's just not just."

But pinning hopes on new LNG development can have serious flaws, says Daniel Kammen, senior advisor for energy at U.S. Agency for International Development. Onshore gas projects in countries like Mozambique and Tanzania likely won't come online until the late 2020s at the earliest, and yet Mozambique has already taken on significant debt in anticipation of future gas profits.

While natural gas prices are high today, that could change as these projects mature, says Laura Page, senior LNG analyst at Kpler, a data analytics firm. She says renewables are getting cheaper and more reliable. Plus countries are considering hydrogen and reconsidering nuclear. "It's very unclear what the trajectory of gas demand is over the next 20 to 30 years," Page says.

If gas prices fall, these new African LNG players might not be able to compete against established producers like the US and Qatar which have lower production costs, Kammen says. "If the demand for gas drops the way it should – if our climate goals mean anything – it's going to be harder and harder for them to recover that investment," he says. "They're going to get crowded out in the waning days of gas."

Gas project offshore and an insurgency onshore

Climate change driven by the use of fossil fuels, including natural gas, is already hammering Africa–including nations that seek to develop gas fields. The Horn of Africa is currently experiencing the worst drought in four decades, with more than 20 million people experiencing extreme hunger. Climate change worsened the vast floods that killed hundreds of people this spring in South Africa, scientists say.

Mozambique is one of the countries most vulnerable to climate change, with more frequent and severe droughts, flooding, and storms. In 2019, two cyclones hit Mozambique in quick succession, killing hundreds. This year, two more large storms also killed hundreds of people. Researchers at the World Weather Attribution initiative, an international group of climate scientists, found global warming made the deluge more severe for the second event, Tropical Storm Ana.

Mozambique is also the continent's third largest holder of proven gas reserves. In 2010, a US oil company made a massive gas discovery off the coast of Cabo Delgado in Northern Mozambique. That began a race for new discoveries as international energy companies flooded in. TotalEnergies announced it would build a $20 billion dollar LNG project to begin exporting Mozambican gas in 2024. ENI, ExxonMobil, and China's CNCP and others announced another $30 billion LNG export project.

But since 2017, a violent insurgency has been spreading in Cabo Delgado. Local militants, some now linked to the Islamic State, have killed at least 4,000 people, including beheading children according to Save the Children. More than 780,000 people have been displaced, according to the International Organization for Migration.

Like many gas-rich countries in sub-Saharan Africa, Mozambique's government has talked a lot about "local content" legislation – the idea that incoming international energy companies should do things like give contracts to local companies and help train the local workforce, says Tony Paul, an energy advisor who recently worked for the Mozambique Ministry of Mineral Resources and Energy.

ENI tells NPR that they have trained almost 1,000 Mozambicans, about a third of whom come from the north of the country. ExxonMobil tells NPR that they've created a web-portal for their gas project where thousands of Mozambican companies can "access relevant supplier opportunities and apply accordingly." ExxonMobil has awarded 19 contracts to local companies as of last month.

But locals in Cabo Delgado say they haven't seen the long-term employment and job training they were expecting. "I remember to hear that a thousand times from locals saying that we are not benefiting," says Fátima Mimbire, an extractive industries researcher and program manager at N'weti, a Mozambican non profit. "The [non-locals] are grabbing all the opportunities while we are just eating the consequences."

She says insurgents have taken advantage of local dissatisfaction with the gas discoveries to recruit people into their ranks. "These insurgents saw opportunities all over the province," she says, "They found a fertile place."

Last March the insurgents launched a coordinated attack on the town of Palma in Cabo Delgado, killing dozens and causing thousands to flee. TotalEnergies, the lead operator of the $20 billion project, stopped operations declaring "force majeure," or events out of their control.

But despite the insurgency ENI and ExxonMobil are moving ahead with a new floating LNG ship offshore. ENI says the timelines for this new gas won't be affected by the conflict on shore.

"Sometime in Q3 [third quarter 2022], we will have the first cargo," Brusco says.

New African gas projects may end up obsolete

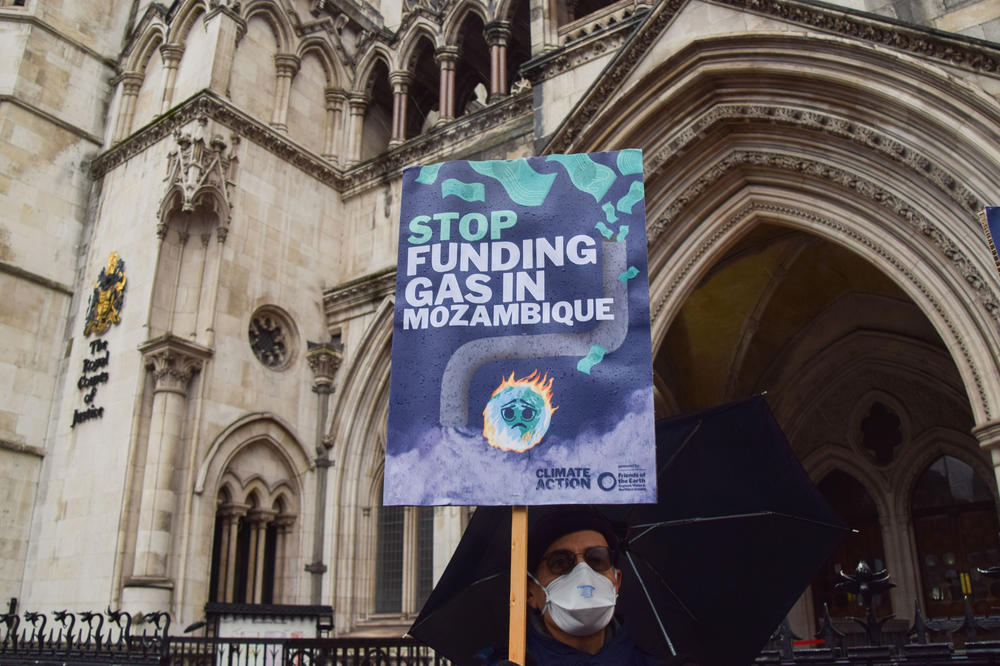

Late last year, the environmental group Friends of the Earth filed a lawsuit in Britain's High Court hoping to stop the U.K. government from giving over $1 billion in financing to TotalEnergies' $20 billion project in Mozambique. The company's CEO has said it aims to restart construction this year.

The suit argued that the U.K. government wrongly assessed the Mozambique LNG project to be compatible with the 2015 Paris climate agreement. One of the two judges agreed with Friends of the Earth, which is appealing the decision.

As more financing challenges mount against fossil fuel projects, there's growing concern that new African LNG plants could become stranded assets, Olan'g says. Stranded assets refer to oil and gas infrastructure that may become worthless when the world shifts away from fossil fuels.

Anderson of Kosmos Energy says his company is launching their projects in phases so they deliver gas more quickly. "[If] you know that you're supplying a need in the market for 5, 10, 15 years, then they're not going to be stranded assets," he says.

ENI is investing in projects set to keep producing well into the 2040s. "We see the challenge, but we feel confident that we will overcome this and will not have stranded assets in our portfolio," Brusco says.

Olan'g says if the projects become stranded, international oil companies could bear responsibility for making African countries believe that this new gas is a safe long-term investment. "I think the government might regret if they actually invest huge public funds into developing these resources which might end up being stranded."

Copyright 2022 NPR. To see more, visit https://www.npr.org.

Bottom Content