Caption

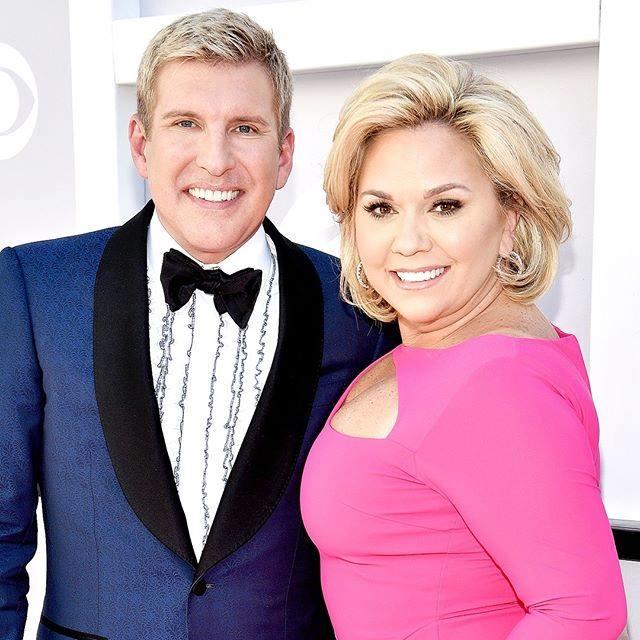

Todd Chrisley, left, and his wife, Julie Chrisley, pose for photos at the 52nd annual Academy of Country Music Awards on April 2, 2017, in Las Vegas. The couple, stars of the reality television show “Chrisley Knows Best,” have been found guilty in Atlanta on federal charges including bank fraud and tax evasion Tuesday, June 7, 2022.

Credit: via Todd Chrisley on Facebook