Caption

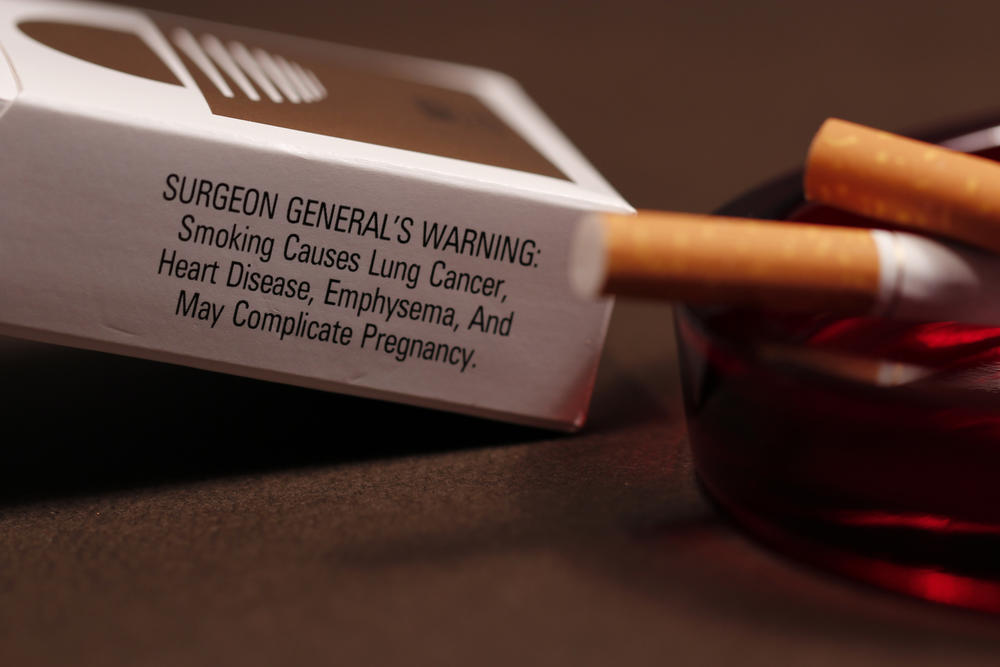

Smoking harms nearly every organ of the body, causing many diseases and affecting the health of smokers in general, as well as those inhaling “second hand” smoke, according to the Centers for Disease Control and Prevention.

Credit: CDC.gov