Caption

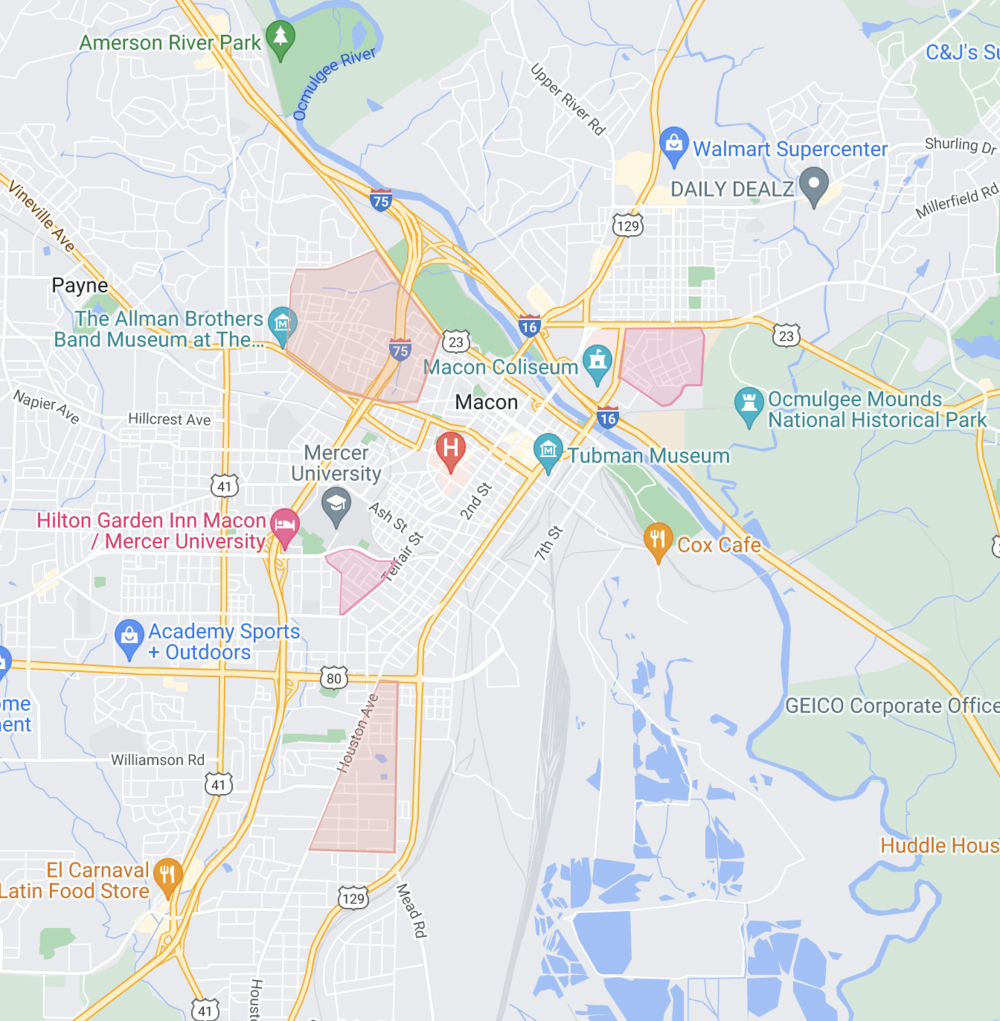

A crew employed by Stafford Construction works on a new home on Ward Street in Macon’s Pleasant Hill neighborhood. Pleasant Hill is one of the places carved out for work by a new, federally funded affordable housing nonprofit group of which Stafford Construction is a member.

Credit: Grant Blankenship / GPB News