Section Branding

Header Content

JPMorgan Chase buys troubled First Republic Bank after U.S. government takeover

Primary Content

Updated May 1, 2023 at 3:26 PM ET

Regulators took over First Republic Bank and sold a substantial chunk of its assets to JPMorgan Chase, marking the third major bank failure in the U.S. in less than two months.

The Federal Deposit Insurance Corporation (FDIC) briefly took control of First Republic over the weekend, before overseeing the sale in what it describes as a "highly competitive bidding process."

JPMorgan said in a press release it would take over First Republic's deposits and a "substantial amount of their assets and certain liabilities."

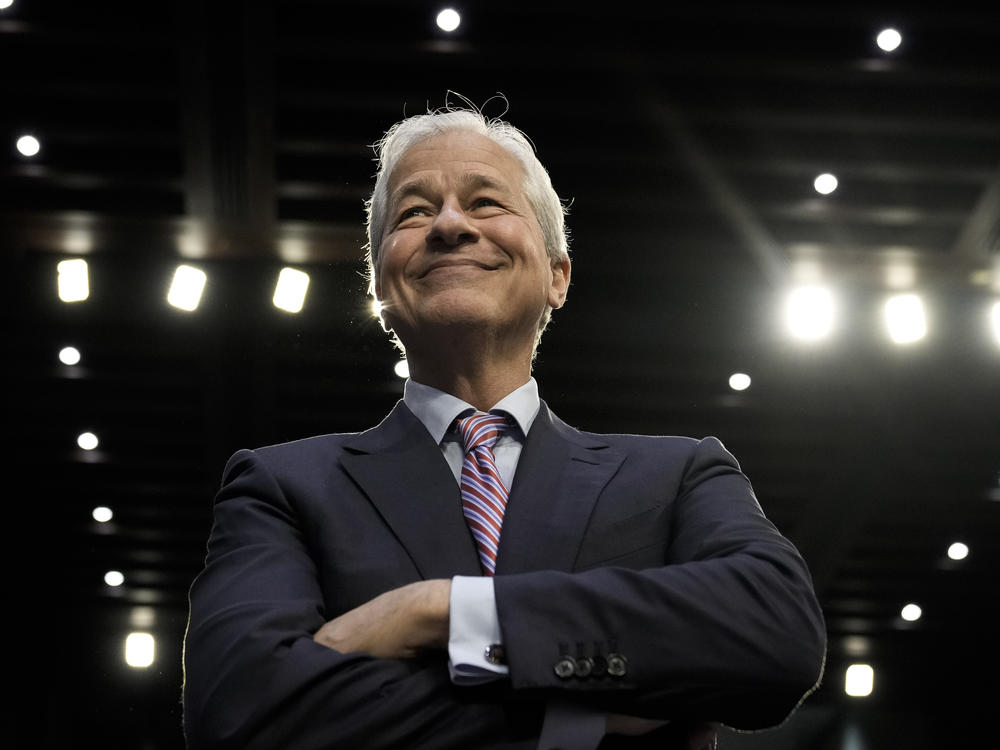

"Our government invited us and others to step up, and we did," JPMorgan Chase CEO Jamie Dimon said in a statement. "This acquisition modestly benefits our company overall, it is accretive to shareholders, it helps further advance our wealth strategy, and it is complementary to our existing franchise."

First Republic's 84 branches opened as JPMorgan Chase Bank branches on Monday, and depositors have full access to their money.

Its takeover caps a rocky week for First Republic, and it marks the latest event in a a period of banking turmoil that has roiled the country's financial system.

First Republic has struggled ever since the U.S. took over Silicon Valley Bank and Signature Bank in March, but its death spiral began in earnest last Monday, when it announced that it had lost about $100 billion worth of deposits during the first three months of the year.

Its stock tumbled so much last week that the New York Stock Exchange halted trading several dozen times. On Friday, shares closed at $3.51 — down more than 97% year to date.

President Biden on Monday welcomed the takeover and sale of First Republic, saying it would "make sure that the banking system is safe and sound," while he emphasized taxpayers would not be on the hook for the rescue.

A death spiral

First Republic is the largest U.S. lender to fail since Washington Mutual in 2008, which was also acquired by JPMorgan Chase.

In March, federal regulators swept in to protect customers of Silicon Valley Bank and Signature Bank after both lenders suffered a run on the bank, with depositors clamoring to take out their money.

Citing potential risk to the broader financial system, regulators took unprecedented action to insure all deposits at the two banks — even deposits that exceeded the FDIC's $250,000 threshold for insurance.

The failure of those two lenders sparked a search for other lenders that would be vulnerable to deposit outflows, and First Republic was soon identified.

The San Francisco-based bank, which was founded in 1985, mostly catered to wealthy clients, offering home mortgages and commercial loans.

First Republic was tossed a lifeline in March after 11 of the country's biggest banks, led by JPMorgan, deposited $30 billion in it in a bid to raise confidence.

Those moves ultimately failed to convince Wall Street, and customers continued to withdraw their money.

First Republic had few options left

First Republic then attempted to sell itself but found few takers, eventually leaving a government-led rescue as the only available option.

The FDIC asked several banks to consider placing bids, and JPMorgan, the largest lender in the country, emerged as the winner.

JPMorgan's Dimon noted the bank made its bid for First Republic in a way that would "minimize costs" to the FDIC's Deposit Insurance Fund.

The FDIC estimates the takeover and sale of First Republic will cost that fund about $13 billion.

For JPMorgan, the acquisition includes the "assumption of approximately $92 billion of deposits" held by First Republic and the acquisition of about $173 billion of its loans and around $30 billion of its securities."

Banking fears have subsided

But unlike Silicon Valley Bank and Signature, whose failures had threatened to spark more bank runs, the situation is calmer now.

Earnings reports from smaller lenders this month showed deposit outflows have largely stabilized.

"That fear, that mass exodus that people were concerned about just didn't happen," says Jared Shaw, a bank analyst at Wells Fargo Securities, who notes lenders were proactive.

"One of the things that the banks did a great job with was reaching out to their customers, explaining their balance sheets, and explaining where their liquidity comes from."

And federal regulators were keen to stress First Republic's woes were not a sign of wider problems in the banking industry.

"Americans should feel confident in the safety of their deposits and the ability of the banking system to fulfill its essential function of providing credit to businesses and families," according to a U.S. Treasury spokesperson.

That's something Dimon echoed in comments he made to reporters after the deal was announced.

"The system is very, very sound," he said.

Bank regulations in focus now

The FDIC actions come as regulators themselves have been under scrutiny about whether they could have done more to prevent the failures of Silicon Valley Bank and Signature Bank.

On Friday, the Federal Reserve took part of the blame for Silicon Valley Bank's failure saying it should have had more aggressive supervision of the lender.

The Fed also recommended adopting a tougher approach to bank regulation, including subjecting more smaller lenders to increased oversight by the Fed.

Meanwhile, the FDIC issued a report Monday outlining possible changes to the country's deposit system.

The FDIC report said that offering unlimited deposit insurance would likely be too costly and could encourage risky behavior by banks.

But it found a targeted increase in the insurance limit for certain business accounts might offer advantages — especially if paired with other moves such as limits on rapid bank withdrawals.

Any change in the deposit insurance system would require congressional authorization.

Copyright 2023 NPR. To see more, visit https://www.npr.org.