Section Branding

Header Content

What you need to know about the debt ceiling as the deadline looms

Primary Content

The federal government is perilously close to being unable to make payments on the country's debt. It is up to Congress to vote to increase the nation's borrowing cap, known as the debt limit. But House Speaker Kevin McCarthy, R-Calif., is in a standoff with President Biden over Republican demands to tie the debt limit to spending caps and other policy demands.

Treasury Secretary Janet Yellen has warned that the country could run out of borrowing authority by June 1, leaving negotiators little time to reach an agreement.

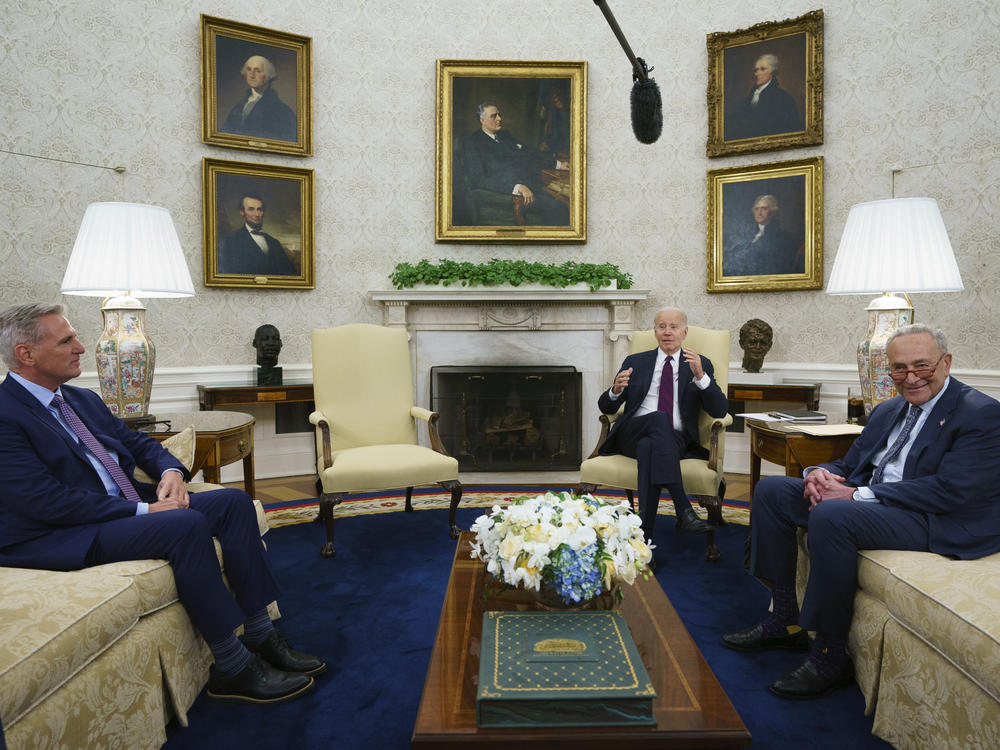

Biden recently met with McCarthy, House Democratic Leader Hakeem Jeffries, D-N.Y., Senate Majority Leader Chuck Schumer, D-N.Y., and Senate Minority Leader Mitch McConnell, R-Ky., to discuss a path forward. The group failed to reach a deal, but staff level talks are ongoing in an effort to avoid default.

Here are nine questions you may be asking about the debt ceiling and the fight over it.

What is the debt ceiling?

The "debt ceiling" or "debt limit" is a cap on how much debt the federal government is allowed to accumulate. Congress is constitutionally required to authorize the issuance of debt. Doing so then allows the government borrow to meet its existing legal obligations like Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds and other payments.

"It used to be that every time you did a Treasury auction where you borrowed, Congress would pass a new law just for that one auction," said Jason Furman, a top economic adviser to former President Barack Obama and an economics professor at Harvard.

"In 1917, the United States needed to borrow a lot of money for World War I," he said. "So in order to simplify that process and make it easier, Congress shifted to a new system where they said, you can borrow up to this amount of money and then come back to us and we'll raise it."

Congress has increased or suspended the debt limit 78 times since 1960, according to the Treasury Department.

How do experts know when the government has really run out of funds?

Economists look at how much the government is expected to bring in through tax payments, when those payments are expected to arrive in Treasury accounts and scheduled debt payments to determine a timeframe, known as an X-Date for when the debt authority might run out.

However, the Treasury Department has access to a few tools, known as extraordinary measures, to avoid default. Those measures include moving investments and deploying accounting tools to shift funds around.

The federal government technically hit the debt limit in January and extraordinary measures have kept payments flowing since then. Experts cannot pinpoint the exact date when funds will run out but they can identify a general range which is expected to fall sometime in early June or possibly as late as July or August.

Why is there a fight over it?

Debt has generally been an unpopular concept in American politics.

Every vote a lawmaker casts is part of that person's political record and many lawmakers do not want to be seen as signing off on more federal borrowing or spending.

Lawmakers also like to tack extraneous priorities onto bills that are seen as must-pass legislation. That makes the debt limit a prime target for political fights.

"Everybody uses [bills to increase] the debt ceiling for their favorite policies," said Maya MacGuineas, the president of the Committee for a Responsible Federal Budget. "The real problem here is that you now have people actually talking about defaulting."

In the past, votes to increase the debt limit were relatively quiet, non-controversial affairs. That changed in 2011 when the country came dangerously close to default.

Mark Zandi, an analyst at Moody's Analytics, said there have been political battles over the debt before but none were as dangerous or consequential as the 2011 fight.

"It wasn't clear up until the very end that lawmakers were going to figure out a way to sign on the dotted line and increase the limit," Zandi said. "The stock market at one point I think was down intraday almost 20%. That's a pretty large market swoon."

At the time, Republican House Speaker John Boehner, R-Ohio, was in a standoff with Obama over spending. Republicans wanted deep spending cuts and caps on how much federal spending could grow after the cuts were enacted.

Obama insisted Congress raise the debt limit without any extraneous policies --known as a clean increase.

Congress eventually reached a deal to increase the debt limit along with caps on future spending but not before the credit rating agency Standard & Poor's downgraded the nation's debt for the first time ever.

Many economists say the situation today is strikingly similar to the political fight in 2011 and there are serious concerns that the country could default.

What could happen if it's not raised?

The Treasury Department would be unable to make payments when they are due. Missing a payment of any kind or size would be considered a default.

Some Republicans have suggested choosing which debts to pay, a system called payment prioritization. Congress would have to pass a law to make that possible, which is politically very unlikely. Most experts say it might also be impossible to execute from a practical standpoint and the idea is not being seriously considered as a solution at this time.

Has the U.S. ever failed to make these debt payments?

No.

And that is part of why the federal government is able to easily sell share Treasury bonds to investors across the globe and why the U.S. dollar is one of the most trusted currencies.

"Treasuries are the debt vehicle that are most trusted in the entire world to the point where even if there is an economic crisis that originated in the U.S., people come and buy treasuries because they trust them," MacGuineas said. "They trust the U.S. they trust the fact that they will get paid if that is called into question, because we actually do start to default and we don't pay the interest that is due. We will never be able to regain that most trusted role in the same capacity we had before"

Would capping or cutting spending now resolve the problem?

No, the debt limit is related to money that has been spent as a result of laws Congress already passed.

"As a mathematical consequence of the laws Congress already passed, you have to borrow a certain amount," Furman said. "This borrowing isn't some unilateral thing that President Biden wants to do in order to do his favorite projects. It is in order to accomplish what Congress told him to accomplish."

In fact, some of the debt being accumulated is the result of laws passed under former presidents, including Donald Trump.

Spending caps and other changes included in a bill passed by House Republicans are separate policies intended to address future debt accumulation, not the current need to increase the debt limit.

What else could be affected by a default?

A U.S. default could cause a huge ripple of negative consequences throughout the global financial system. Any hit to the country's credit rating could do long-term harm to the value of U.S. treasuries and make the country a less appealing investment.

"I am truly concerned there is an actual chance of default and that is so dangerous and such a sign that the U.S. is not able to govern itself in a way that is functioning," MacGuineas said. "We should all be worried both about the debt ceiling itself, but also about what it says about our politics."

Zandi warned that the consequences could go beyond just investment and lending rates.

"Don't worry about your stock portfolio, worry about your job," he said. "Because a lot of jobs are going to be lost. Unemployment is going to be a lot higher. Is the economy struggling already trying to avoid recession because of high inflation, high interest rates? This will certainly push us and, you know, it's going to be about layoffs. Stock portfolios will be the least of people's worries."

Furman said it could be worse than the 2008 financial crisis when the fall of Lehman Brothers Bank triggered a global financial crisis.

"It could be worse than Lehman Brothers, where everyone basically demands their money back because they don't believe the collateral anymore," Furman said. "And you have the equivalent of a run on the global financial system."

Is default the same thing as a shutdown?

No. A government shutdown occurs when Congress fails to authorize annual spending bills before the end of the fiscal year on Sept. 30.

The two issues sometimes become linked because lawmakers have occasionally extended the debt limit to intentionally align with the end of the fiscal year in order to force broader spending discussions alongside the debt authorization.

Are there other ways this problem could be fixed, aside from just increasing the debt limit?

Most experts agree the current debt limit process isn't working. MacGuineas of the Committee for a Responsible Federal Budget said Congress should be reassessing debt and spending priorities but the debt limit mechanism does not actually force them to make choices.

"The debt ceiling is a terrible way to try to impose fiscal responsibility," she said. "It doesn't make sense. It says after you vote to borrow a lot of money then you will then vote whether to actually make good on those bills. That's a dumb approach."

Instead, she suggested a system where Congress agrees to increase the debt limit when they pass legislation.

Others economists have suggested abolishing the debt limit entirely.

Other less popular proposals include minting a $1 trillion platinum coin to cover the debt or raising it so high that the next debate will be stalled for years or decades.

Copyright 2023 NPR. To see more, visit https://www.npr.org.