Section Branding

Header Content

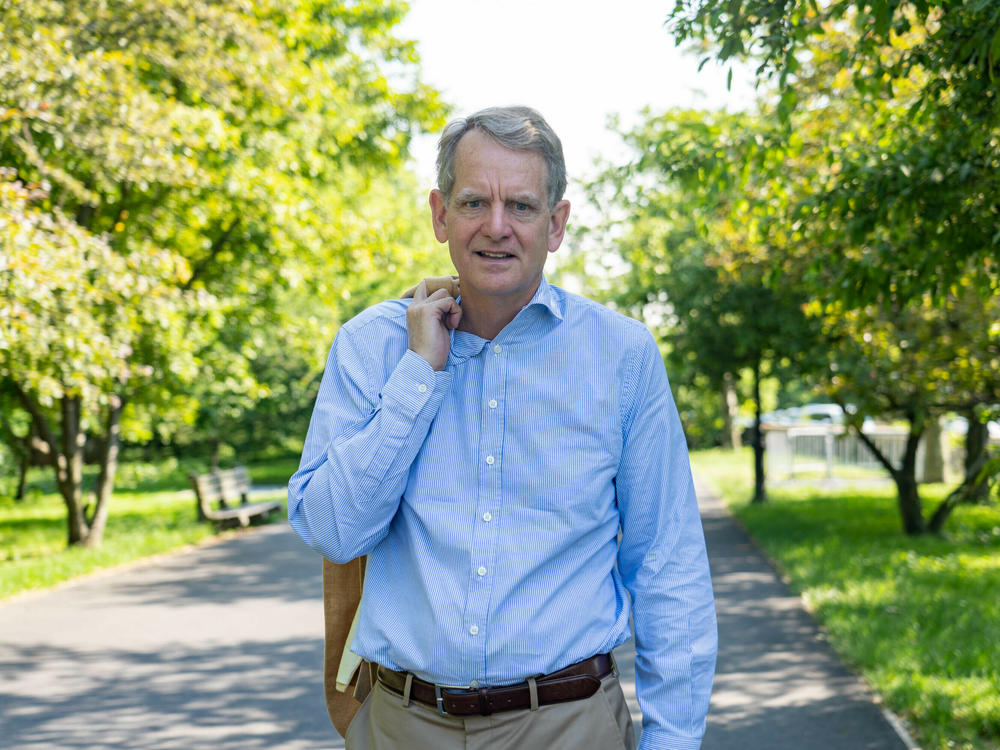

He took away the country's top AAA rating in 2011. He ended up fearing for his life

Primary Content

More than a decade ago, John B. Chambers and his colleagues at Standard & Poor's made a momentous decision: They were going to strip the United States of its cherished AAA credit rating.

Going into it, Chambers, who led the powerful committee at S&P that rates the creditworthiness of more than 100 countries, knew it would be a huge deal.

The U.S. is the world's largest economic power, and for decades, it had held a AAA rating from all three major rating agencies — Fitch, Moody's, and S&P.

That rating is a status symbol, a nod of approval that the U.S. can be counted on to pay its bills on time no matter what.

But in the summer of 2011, negotiations over raising the debt limit had dragged on and on. President Obama and House Speaker John Boehner were at loggerheads.

House Republicans and Obama eventually clinched an agreement to avoid a devastating default. But by then, Chambers had seen enough.

Despite the deal, he and his colleagues felt strongly that the country's political divisions were making it too difficult for the government to make critical decisions about its finances and its policies.

So the committee Chambers chaired held an up-or-down vote, and S&P rendered its judgment: to lower the U.S. credit rating by one notch, to AA+.

"It was probably the most important decision I made in my career," says Chambers. "We didn't come to it lightly."

Market mayhem

The announcement landed on a Friday, after U.S. markets had closed. Predictably, the impact was seismic. It fueled a global sell-off.

On the first day of trading after the announcement, the Dow Jones Industrial Average dropped by more than 600 points, and the Nasdaq closed 6.9% lower. Markets hadn't had a day that bad since the Global Financial Crisis.

Chambers appreciated the magnitude of the unprecedented decision he and his colleagues made — ratings agencies are used to pushback from the companies and countries they analyze, and he knew well how their decisions can impact markets. But he was unprepared for the kind of vitriol he faced.

Like other members of his committee, Chambers was inundated with hate mail. So was his boss, David Beers, who remembers using his BlackBerry to reply to a few of those angry messages. But Beers was in London, and that made a difference.

"I had an easier time with it than John Chambers did," he says.

Fearing for his life

Chambers was the public face of the downgrade. He defended it on CNN's Anderson Cooper 360° and MSNBC's Morning Joe. And before long, he started receiving serious threats.

"Every time I walked my dog, in the morning and in the evening, I had a bodyguard with me," he says. "I didn't take the subway for six months, because people thought I might get pushed in front of an oncoming train."

The White House was furious. The administration challenged S&P's decision, and its methodology.

President Obama addressed the downgrade in a speech to the American people, and his Treasury secretary, Tim Geithner, could barely contain his outrage during an appearance on CNBC.

"I think S&P has shown really terrible judgment, and they've handled themselves very poorly," Geithner said.

Officials pushed back on what they later called a "$2 trillion mistake" in the rating agency's math.

S&P acknowledged that error, but in a follow-up statement, argued it didn't significantly change the company's calculus, or its determination.

"None of these key factors was meaningfully affected by the assumption revisions to the assumed growth of discretionary outlays and thus had no impact on the rating decision," S&P wrote.

No regrets

More than a decade later, Chambers is now retired, living in New York. And as he followed the latest fight over the debt ceiling, he spent a lot of time reflecting on that protracted debate in 2011, and S&P's downgrade.

Today, Chambers feels vindicated. If anything, Chambers says, the country's politics have become even more fractious from the time he and his colleagues made the call to downgrade the U.S.

"It would be hard to deny that political polarization in the United States has done anything other than worsen," he says. "Certainly the fiscal position is worse."

S&P hasn't raised the U.S.' credit rating since 2011, and now, the U.S. is at risk of losing its top-tier rating from another major credit rating agency.

In May, Fitch Ratings gave a formal warning it could downgrade the country's AAA credit rating. That notice echoes what S&P said more than a decade ago. A big risk factor is a bitterly divided government.

Last week, just hours after Congress passed a deal to suspend the debt limit, Fitch said the agreement didn't change its outlook.

"Repeated political standoffs around the debt limit" end up lowering "confidence in governance on fiscal and debt matters," it noted.

A final warning

Some 12 years after Chamber and his colleagues made that consequential call, Chambers continues to worry the country won't be able to get past its political divisions.

He acknowledges how much the U.S. has going for it — despite these recurrent debates over the debt limit, and close calls with default: The country's financial markets are unmatched, and the dollar is the dominant currency worldwide.

But Chambers is concerned the U.S. is squandering its economic supremacy.

"When you have incidents like this, it puts all of that at risk," he says. "It chips away at the confidence that people have in the U.S."

Copyright 2023 NPR. To see more, visit https://www.npr.org.