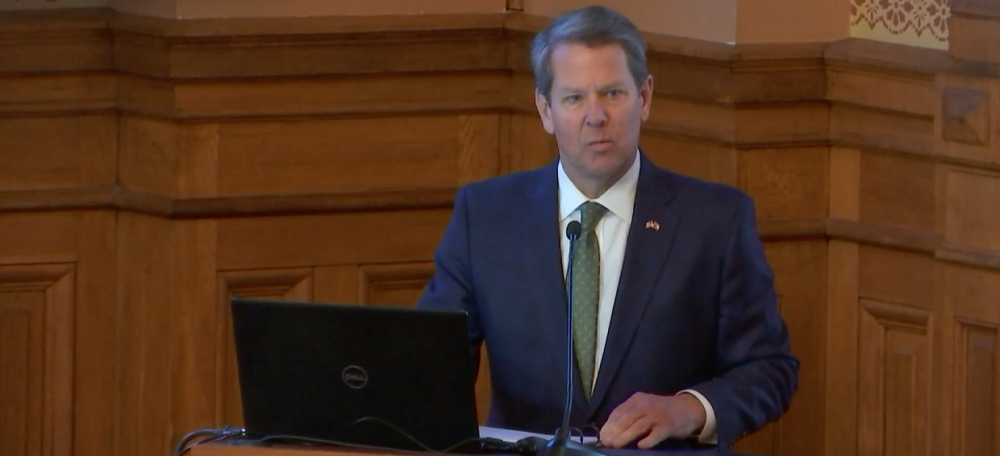

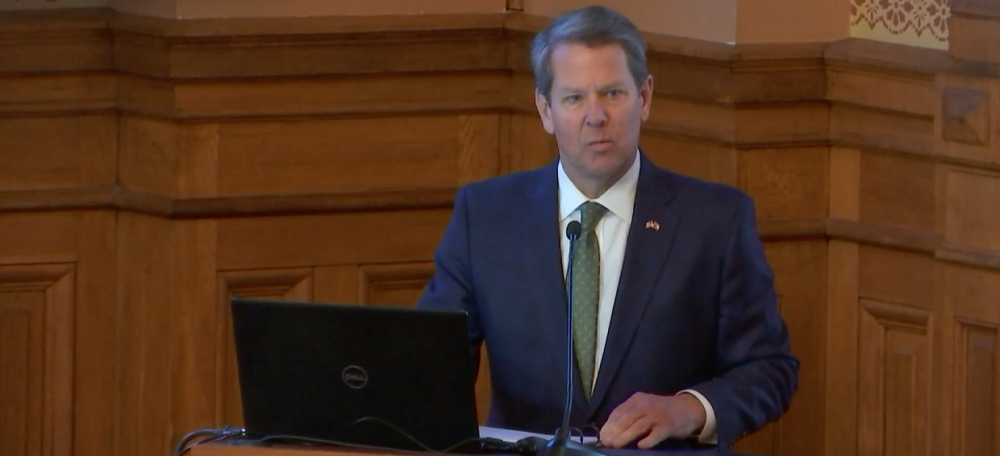

Caption

The Gov. Brian Kemp announced Wednesday, Aug. 2, 2023, that state agencies can ask lawmakers to increase spending by 3% in upcoming budgets.

LISTEN: The largest part of Georgia’s 2024 state budget funds health care and education, but analysts with the Georgia Budget and Policy Institute say lawmakers are leaving billions in the bank instead of helping Georgians. GPB’s Ellen Eldridge has more.

The Gov. Brian Kemp announced Wednesday, Aug. 2, 2023, that state agencies can ask lawmakers to increase spending by 3% in upcoming budgets.

Gov. Brian Kemp acknowledged on Wednesday that the state coffers are full because of a massive budget surplus and a growing economy. The Associated Press reported that Kemp told state agencies they can ask for up to 3% more in next year’s budget.

Richard Dunn, director of Georgia's Office of Planning and Budget, invited spending proposals for the surplus "targeted at initiatives that can 'move the needle' on program outcomes, improve customer service, or provide future improvement on how we do business or deliver services as a state."

But struggling residents need help now, according to the Georgia Budget and Policy Institute.

While the fiscal 2024 budget signed into law by Kemp increased spending by more than $2 billion, the state has a surplus of roughly $16 billion, the GBPI said.

The nonpartisan organization is calling for a restructuring of the state’s broken systems to stabilize and strengthen state and local communities.

These are public dollars that belong to Georgians and should be supporting the needs of Georgians — GBPI CEO Staci Fox

Since 2021, large surpluses began accumulating because the federal government made a huge investment in preventing what could have been one of the deepest recessions in generations because of COVID-19, GBPI senior policy analyst Danny Kanso said in a virtual town hall Aug. 2.

Coupled with surging income tax revenue numbers, Georgia is likely to produce a surplus for what would be a fourth consecutive year, which Kanso said is unprecedented.

“So, actually, last year the state collected almost $17 billion in personal income taxes, and that was actually down from the year before,” Kanso said. “The governor estimates about $14.8 billion for next year, about 14% less than we collected last year, which I think is unlikely.”

GBPI CEO Staci Fox said it’s inaccurate to call money in the bank a “surplus” unless all fiscal obligations are met.

Additionally, Kemp’s budget has an unprecedented use of both vetoes and what are called ‘budget disregards’ that primarily have the same effect, meaning that the funding that was approved by the General Assembly will not be allocated for the uses in many cases approved by the General Assembly.

“So, what we see is a little bit over $100 million in budget disregards that will affect the Department of Behavioral Health and the Department of Community Health and Medicaid,” Kanso said.

These are public dollars that belong to Georgians and should be supporting the needs of Georgians, Fox said, not withheld due to out-of-touch budgeting practices that are strangling resources and undermining economic stability.

Kanso added that Kemp said to disregard an additional $20 million to public education and about $25 million in a cost-of-living adjustment that would have been made for retired city employees.

“So, again, a really unprecedented use,” he said. “You can see that more disregards and vetoes were issued last year than in the entire four preceding years of Gov. Kemp's governorship.”

Georgians who are making the least less than $20,000 a year, for the most part, are paying about 10% of their income in state and local taxes, much of that in sales taxes, Kanso said.

“You can see as earnings go up, you're statistically likelier to pay a lower share of what you earn in state and local taxes,” he said.

It’s a problem, he said, that continues to expand what is a historical legacy of huge disparities across income and race through the same systems that caused one of the greatest disparities in the nation.