Caption

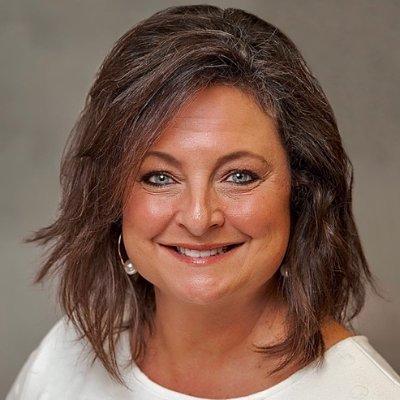

Tifton Mayor Julie Smith asked Georgia lawmakers to fix a system of distributing local sales tax dollars between counties and cities.

Credit: Twitter

Tifton Mayor Julie Smith asked Georgia lawmakers to fix a system of distributing local sales tax dollars between counties and cities.

ATLANTA — The mayor of Tifton asked Georgia lawmakers Monday to fix a system of distributing local sales tax dollars that favors counties at the expense of cities.

Under current state law, cities and counties that can’t agree on how to allocate local sales tax revenues between them must submit to an arbitration process that skews toward counties, Julie Smith told a Senate study considering potential changes to the system.

A county that doesn’t like a city’s offer has the right to abolish its local option sales tax (LOST) in favor of an alternative called the homestead option sales tax (HOST), which is used to reduce property taxes on owner-occupied housing and infrastructure.

Since counties don’t have to share HOST revenue with cities, counties can use it to threaten cities during negotiations over allocating local sales tax dollars, Rusi Patel, general counsel for the Georgia Municipal Association, said Monday.

“One party has that as a hammer,” he said.

Smith said that’s what happened last year when the city of Tifton and Tift County sat down to negotiate. She said the city had built a strong case for its request that Tifton get 45% of the local sales tax revenue but was forced to settle for 30% after the county threatened to adopt a HOST and the talks got confrontational.

“It got ugly, and it got ugly publicly,” Smith said. “The people who are suffering because of that are the citizens when we can’t sit down and look out for their wellbeing.”

Patel said similar controversy has marred local sales tax negotiations between other Georgia cities and counties.

“While it’s not most local governments that are fighting, it’s probably too many,” he said.

Smith said the process needs greater transparency. The agreement Tifton and Tift County reached last year was accomplished without a public hearing, although the city asked for one, she said.

“The voters want to see the process,” Patel added. “If you don’t see what the counties and cities are doing, it’s hard to know why they’re fighting.”

Smith said one potential solution could be to link negotiations between cities and counties over distribution of local sales tax revenue with service delivery agreements between the two parties. As with allocating local sales taxes, state law requires local governments to negotiate new service delivery agreements every 10 years to avoid service duplication and double taxation.

“This has got to be fixed,” Smith told members of the study committee. “Please do what you can to help us.”

Sen. Derek Mallow, D-Savannah, said the study committee will hold two more meetings in Griffin and Savannah before returning to Atlanta for a final meeting that could lead to recommendations for the full Senate to consider early next year.

This story comes to GPB through a reporting partnership with Capitol Beat News Service.