Section Branding

Header Content

Toxic culture is the norm at the FDIC, outside review cites 500 employee complaints

Primary Content

An outside review of the Federal Deposit Insurance Corporation found a toxic workplace where hundreds of employees complained of sexual harassment, discrimination and other misconduct which went largely ignored by the agency's management.

The investigation was commissioned after a scathing report last fall in the Wall Street Journal, which documented strip club visits, lewd messages, heavy drinking and bullying at the government agency, which is responsible for safeguarding Americans' bank deposits.

The report found that "a patriarchal, insular, and risk-averse culture" at the FDIC allowed the misconduct to continue, and that complaints were discouraged by "a widespread fear of retaliation."

Culture 'starts at the top'

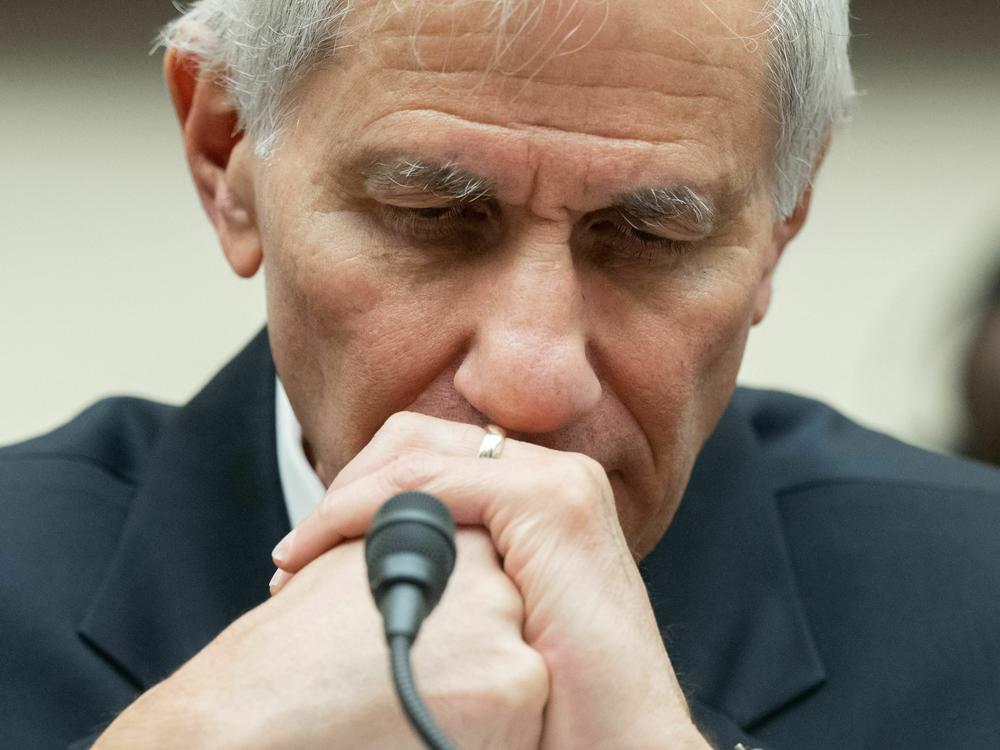

In a message to employees Tuesday, FDIC chairman Martin Gruenberg apologized to those who were harassed and mistreated, and he promised to implement the recommendations from the outside review. Those include an agencywide cultural transformation, efforts to protect victims and a push to hold leadership more accountable.

Authors of the report questioned, however, whether Gruenberg is the right person to bring about the necessary changes.

"While we do not find Chairman Gruenberg's conduct to be a root cause of the sexual harassment and discrimination in the agency," the report said, "as a number of FDIC employees put it in talking about Chairman Gruenberg, culture 'starts at the top.'"

Calls to resign

The report noted that Gruenberg has spent nearly two decades at the FDIC, including ten years as chairman, and that he has a reputation for losing his temper.

Rep. Patrick McHenry, R-N.C., who chairs the House Financial Services Committee, called on Gruenberg to resign.

"The independent report released today details his inexcusable behavior and makes clear new leadership is needed," McHenry said in a statement. "Republicans will ensure Chair Gruenberg and other senior leaders at the FDIC are held accountable."

More than 500 FDIC employees contacted the law firm conducting the outside review to report misconduct at the agency.

The review found that bad actors were rarely punished, but instead simply transferred or even promoted.

"The FDIC's response to interpersonal misconduct is 'pay, promote, or move them,'" the report said.