Caption

An aerial view of the Hyundai Motor Group Metaplant America in Bryan County, Georgia. Taken August 6, 2024.

Credit: Courtesy of Hyundai Motor Group

An aerial view of the Hyundai Motor Group Metaplant America in Bryan County, Georgia. Taken August 6, 2024.

A Georgia Republican who has endorsed former President Donald Trump is concerned about the potential repeal of the Inflation Reduction Act, which has brought billions of dollars of clean energy investment to Georgia.

Last Tuesday, 18 House Republicans sent a letter to House Speaker Mike Johnson (R-La.) emphasizing the importance of maintaining energy tax credits in the Inflation Reduction Act if Trump were to be elected in November. Trump has said he would repeal the Inflation Reduction Act on his first day in office and has called electric vehicle mandates the “death of the U.S. auto industry.”

But the act has put more than $352 billion into clean energy across 47 states. In Georgia, $24 billion has been invested and 30,661 jobs have been created, according to Climate Power, a climate communication organization. The Peach State leads the U.S. in clean energy job creation, Climate Power says.

Rep. Buddy Carter, of Georgia’s 1st District encompassing Georgia’s coast and inland to Waycross, was one of the 17 co-signers. His district has received $7.6 billion, more than a third of the state’s clean energy manufacturing investment.

“We must find a balance between rolling back the worst portions of the (Inflation Reduction Act) and ensuring that companies have the stability they need to continue investing in the United States,” Carter said in a statement.

U.S. Rep. Earl L. “Buddy” Carter presides over Georgia’s First District.

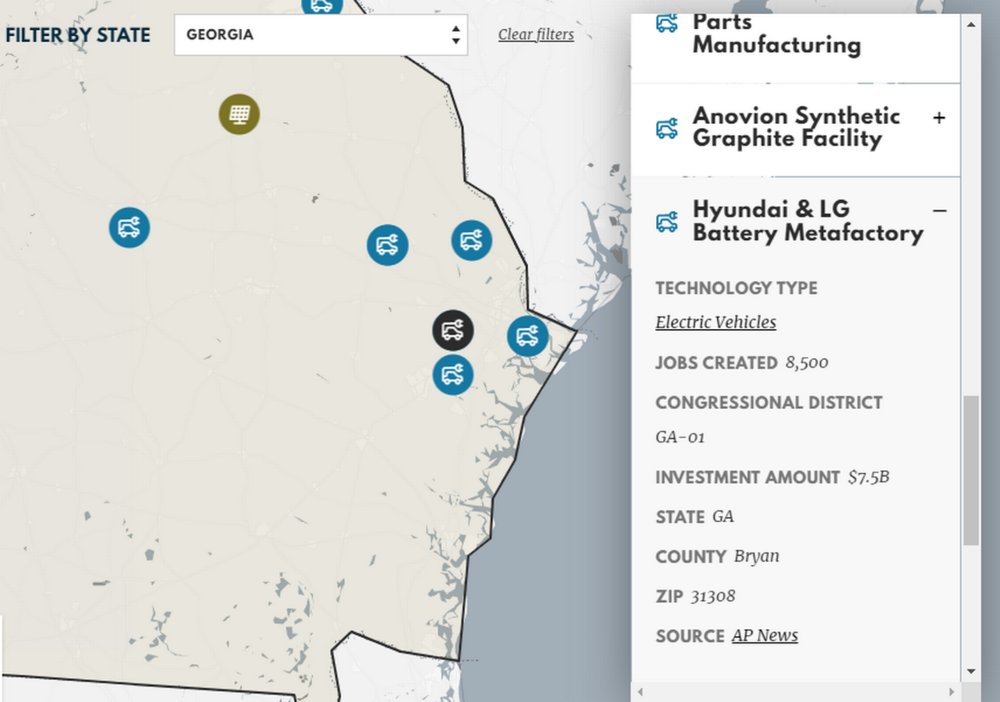

Three major projects in Southeast Georgia include the Hyundai EV Metaplant and LG Metafactory, worth $7.5 billion and bringing 8,500 jobs. The Seoyon E-HWA EV Parts invested $76 million and brought 740 jobs. These current and ongoing projects numbers are according to a new clean energy map by Thirdway, a nonprofit think tank dedicated to climate policy.

Mapping Our Clean Energy Future shows three major EV manufacturing projects in Southeast Georgia. Hyundai & LG Battery Metafactory are part of Rep. carters district.

“A full repeal (of the Inflation Reduction Act) would create a worst-case scenario where we would have spent billions of taxpayer dollars and received next to nothing in return. Energy tax credits have spurred innovation, incentivized investment, and created good jobs in many parts of the country …,” the letter warns Johnson.

The letter was spearheaded by Rep. Andrew Garbarino (R-N.Y.), the co-chair of the bipartisan House Climate Solutions Caucus.

Hyundai chose Georgia for its access to ports and rails in Savannah, but specifically came to the U.S. and broke ground in Georgia because of the tax credits laid out in the act, according to a report by the Associated Press.

Carter said Hyundai decided to come to his district before the passage of the act.

“I am excited to have Hyundai as a strong partner in Georgia’s First Congressional District, a decision that predates passage of the (Infaltion Reduction Act), and will continue to push for pro-growth policies so that we can empower consumers and beat China,” he said in a statement.

This is an aerial view of the Hyundai Motor Group Metaplant America in Bryan County, Georgia.

Georgia has seen tax benefits from the act beyond business investment too, according to government studies. Just last week, the IRS published new data that highlighted tax credit benefits at the household level.

“87,000 Georgia families benefited from more than $148 million in tax credits to lower the costs of clean energy and energy efficiency upgrades to their homes during 2023,” according to Climate Power’s analysis.

Home improvements like heat pumps, insulation, windows, and efficient air conditioning are part of the credits as well.

This story comes to GPB through a reporting partnership with Ledger-Enquirer.