Section Branding

Header Content

Why The Racial Wealth Gap Is So Hard To Close

Primary Content

It's been almost 160 years since Union General William T. Sherman led 60,000 soldiers on his "March to the Sea," a scorched-earth campaign through Georgia aimed at bringing the American Civil War to a quicker end. Shortly after, Sherman met with a group of black ministers in Savannah to discuss the future. With slavery over and the war coming to a close, these community leaders told Sherman what their newly freed people wanted: land. Land, after all, was then the most important form of wealth, the key to a more prosperous life.

Four days after the meeting, on January 16, 1865, Sherman issued Special Field Order No. 15, which confiscated from Confederate landowners about 400,000 acres along the coast, stretching from Charleston, South Carolina, down to St. John's River in Florida. The order, which received President Abraham Lincoln's approval, redistributed that land — in 40 acre parcels — to newly freed slaves. Later, Sherman ordered that the Union Army lend these new landowners mules to help them harvest their land. And that's how we got the well-known phrase: "40 acres and a mule."

But, a few months after approving Special Field Order No. 15, Lincoln was assassinated. And his successor, Andrew Johnson, was a turncoat. He quickly began reversing pro-Black policies of the Lincoln Administration, including the policy of redistributing 400,000 acres of Confederate land to freed slaves. Johnson returned the land to the white Southern planters who originally owned it, and America's freed slaves were never compensated for centuries of exploitation and oppression.

"Thus, the efforts to provide the freedman with land and tools ended, and by 1870 he was left to shift for himself amid new and dangerous social surroundings," wrote the scholar W.E.B. Du Bois in 1901. "No such curious and reckless experiment in emancipation has been made in modern times."

Fittingly, economists Ellora Derenoncourt, Chi Hyun Kim, Moritz Kuhn, and Moritz Schularick begin their new study about the racial wealth gap with this quote from Du Bois. The study is the first to construct a long-run dataset on racial wealth disparities, extending from 2020 all the way back to 1860, the eve of the Civil War. It's titled "Wealth of Two Nations: The U.S. Racial Wealth Gap, 1860-2020."

This new study adds to a growing body of evidence showing that, despite ostensible progress made since the civil rights movement, when it comes to the most important, bread-and-butter economic issues of income, wealth, and mobility, progress in ending racial inequality is stalling — or even reversing. The study brings into focus the simple math of why — absent radical measures — America won't be seeing true racial equality anytime soon.

Wealth Of Two Nations

Ellora Derenoncourt is a young economist who has burst into the limelight of econ nerdom with a series of eye-opening papers about racial inequality. She completed her PhD in economics from Harvard in 2019, and, last year, she was appointed by Princeton University as an assistant professor. She's the founder and director of Princeton's Program For Research On Inequality.

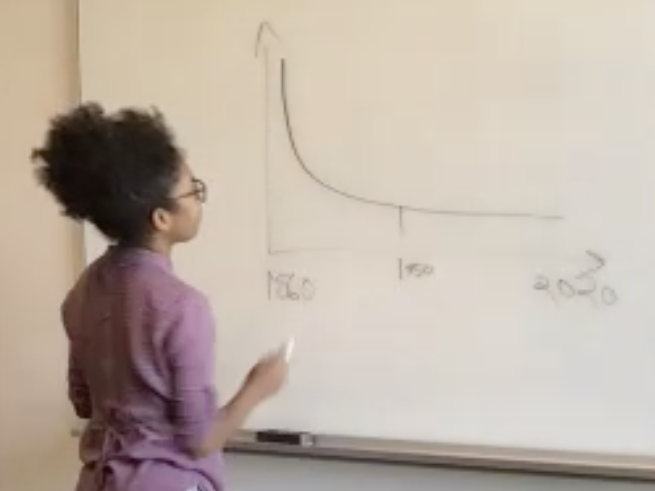

Derenoncourt was kind enough to walk us through her new study on a Zoom call. When we asked her about the long-run pattern of racial wealth inequality she and her colleagues have uncovered, she turned to her white board and drew a picture. The vertical axis of the graph is the degree of racial wealth inequality (the ratio of white-to-Black wealth). And the horizontal axis is years.

Describing the data pattern as a "hockey-stick shape" (with the hockey stick lying on its handle), Derenoncourt showed that the degree of wealth inequality between white and Black people was extremely high in 1860 and then rapidly plunged through the late 19th and early 20th centuries. From 1950 onward, however, it has remained pretty flat. That is, there's been virtually no progress in closing the wealth gap. In fact, the study finds, since the 1980s, the gap has been widening.

Let's start back in 1860. This was before Emancipation, when about 4 million of the 4.4 million Black people in America were enslaved. Slavery robbed the vast majority of Black Americans of the ability amass wealth and pass it on to their children. They themselves were a form of wealth — other people's wealth. In this barbaric world, the ratio of white-to-Black wealth was 56 to 1. Said in a different way, for every dollar the average white person had, the average Black person had only about 2 cents.

Despite President Johnson rescinding the 40-acres-and-a-mule order, Black Americans made huge progress reducing the wealth gap in the first years after Emancipation. By 1870, just five years after passage of the slavery-abolishing 13th Amendment, the white-to-Black wealth gap dropped to 23 to 1, less than half what it was.

Why did the racial wealth gap fall so quickly? One reason is the effect the Civil War and abolition had on white slaveowners. Enslaved people had been a huge form of wealth — about 15% of the total wealth of white America in 1860. Hence, their liberation reduced the average wealth of white America, thereby shrinking the racial wealth gap.

However, Derenoncourt and her colleagues calculate that only about 25% of the drop in the racial wealth gap can be explained by white slaveowners' losses. Instead, they find, most of the reduction was the result of newly freed people being able to earn, save, invest, and amass wealth for the first time.

As inspiring as the story is of an oppressed people embracing freedom and working hard to build a better life for themselves against all odds, it's also important to note that a large part of the reason for the steep decline in the racial wealth gap in these early years reflects some simple math. When one group starts off with basically zero wealth, even tiny gains in wealth look huge. When the denominator (the bottom part of the fraction) of the white-to-Black ratio goes from nothing to something, wealth inequality falls sharply.

It's largely for this reason that the economists find that, despite the failure of Reconstruction, the imposition of Jim Crow apartheid, and the countless other stomach-churning injustices perpetuated against Black Americans in this era, the first 50 years after Emancipation saw the greatest progress in narrowing the racial wealth gap in American history. What had been a 56-to-1 wealth gap fell to a 10-to-1 gap by 1920. That is, by 1920, for every dollar the average White American had, Black Americans had about ten cents.

A hundred years ago, it might have looked like Black Americans were on the fast-track to closing the wealth gap with white Americans. However, progress has slowed since then, and starting in the 1980s, the gap began widening.

The Racial Wealth Gap In Modern Times

Despite all the ostensible progress Black Americans made in politics, business, and culture in the mid-to-late 20th and early 21st centuries, the economists find there's been very little progress in closing the average racial wealth gap since 1950. By 1950, the ratio of white-to-Black wealth fell to 7 to 1. Today, it's 6 to 1. For every dollar the average white American has, the average Black American has only about 17 cents. (For those wondering about the median, it's even worse: for every dollar the median white household has, the median Black household has just 10 cents).

How could this be? Haven't Black Americans made a bunch of progress since the civil rights movement? Why hasn't that translated into big gains in wealth?

To help explain what's going on, Derenoncourt and her colleagues conduct a thought experiment. They create a sort of dream simulation to see what the racial wealth gap would look like had Black Americans lived in a more equal world post-Emancipation and had been able to amass wealth at the same exact rate as white Americans. That is, starting at the extreme level of wealth inequality we saw in 1860, the simulation shows what the racial wealth gap would look like had Black Americans been able to achieve identical rates in savings and capital gains. Such a scenario would have required overcoming segregation, discrimination in labor markets, scars from slavery and concentrated poverty, exclusions from social welfare programs, barriers to buying homes in nice neighborhoods, hurdles to obtaining bank accounts, loans, stock portfolios, and so on.

The economists find that in this more equal dream world, the white-to-Black wealth ratio today would be 3 to 1, as opposed to 6 to 1. That's a pretty huge difference. It's half as much wealth inequality. Yet, the average Black American would still only have a third of the wealth of the average white American.

Even with all the benefits bestowed to Black people in this dream scenario, Derenoncourt says, the graph of the evolution of racial wealth inequality still has the same "hockey-stick" shape that they observe with the real-world data. That is, wealth inequality falls sharply after Emancipation, and then around the mid-20th century, progress in closing the gap slows considerably. That's because of the math of trying to close the wealth ratio.

"If you start with something in the denominator that's very small, which is how we started this whole experiment in Emancipation, then the initial increases in that denominator are going to have the biggest effects on that ratio," Derenoncourt says. "And then over time, the rate of convergence is just going to get smaller and smaller."

The reality is it takes time to amass wealth. And having wealth makes more wealth for you. It snowballs. This makes it extremely hard for a group that started off way behind to catch up.

"Wealth is an inherently historical object because it goes from one generation to the next," Derenoncourt says. "It accumulates over time. This is the kind of mathematical law that we've locked into, given where we started."

Derenoncourt and her colleagues find that there was, in fact, some progress on the wealth front during the civil rights movement in the 1960s and 1970s. Black Americans were able to amass wealth at a rate slightly faster than the economists' dream simulation. This was, in large part, because Black Americans saw significant income gains back then.

However, starting in the 1980s, the racial wealth gap stopped closing and began widening. In the economists' dream simulation, convergence would have continued. One important reason for this reversal is Black Americans stopped making progress in catching up to the incomes of white Americans. Stuck with lower incomes, they've trailed behind in their ability to save and invest.

Another reason, according to these economists, is that the average Black American invests their savings differently than the average white American. Derenoncourt and her colleagues note that Black households hold around two-thirds of their wealth in housing, and they are much less likely to hold stocks. Since 1950, they write, stocks have appreciated around five times more than home values.

Adding to this wealth-accumulating disparity, having income-generating wealth — as opposed to earning income through labor — has gotten much more important to making money in recent decades. Without much wealth, Black Americans have been unable to benefit from surges in housing, stock, and other asset markets.

Derenoncourt says their dream simulation tells us something important about hopes to close the racial wealth gap. It's common for politicians to emphasize education or job training or financial literacy or schemes to get Black Americans to buy homes or invest in the stock market. That would help. However, even if we were able to juice the statistics, boost the Black savings rate, and help the average Black American make investments that earn much higher returns, they would still remain way behind in accumulating wealth.

"The best we would go is from a wealth gap that's increasing right now to one that's continuing to converge at this extremely slow rate," Derenoncourt says. "The wealth gap around the time of the Civil War was just so huge. If you start from there, then by 1950, you're in the flat part of the convergence path. And you're just going to be kind of slowly converging — even if people have the same opportunity to accumulate wealth, and that hasn't been the case."

If America really wanted a policy to completely close the racial wealth gap sooner rather than later, Derenoncourt says, the only thing that would do it anytime soon is some sort of big wealth redistribution. Something akin to but even bigger than General Sherman's order to give Black Americans 40 acres and a mule.

While it remains politically unpopular, there's been a growing intellectual movement in recent years to provide Black Americans reparations. The scholars William Darity Jr. and A. Kristin Mullen put the price tag of a reparations program to fully close the racial wealth gap at around ten to twelve trillion dollars. It's a jaw-dropping amount. But one way of understanding it is as a kind of debt, a debt that America has spent centuries failing to pay off.

Copyright 2022 NPR. To see more, visit https://www.npr.org.