Section Branding

Header Content

Two major student loan grace periods are set to expire this week. Here's what to know

Primary Content

Two federal measures designed to help student loan borrowers with their payments are set to expire this week.

Since federal student loan payments resumed last October, borrowers have received some assistance with the transition largely through two federal supports — one that softens the repercussions for missed or late payments, the other that helps borrowers with defaulted loans to get back on track.

The grace period for missed or late payments will sunset Monday. The deadline for the program for defaulted loans, known as Fresh Start, is now Wednesday.

On Monday afternoon, James Kvaal, the under secretary of education, announced that defaulted borrowers have until Wednesday at 3 a.m. ET to enroll in Fresh Start.

These two supports were only made to last about a year. Starting in October, borrowers with delinquent payments or defaulted loans will be at risk once again of consequences like having their wages seized or negative credit reporting.

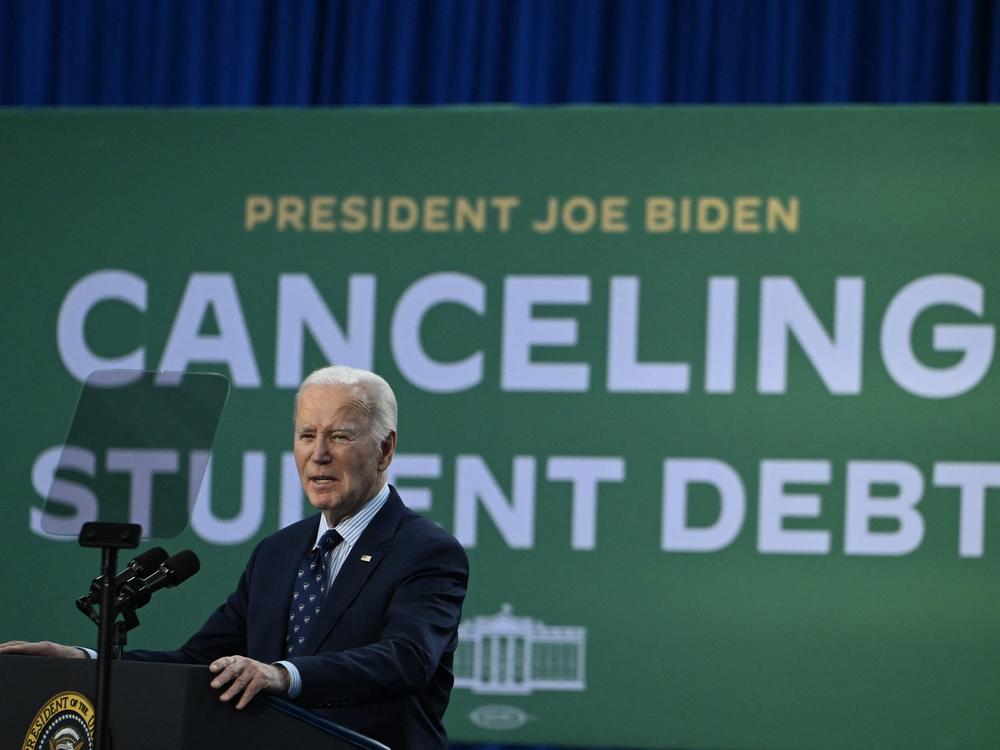

It comes as Biden administration's big income-driven repayment plan, known as SAVE, remains on hold due to legal challenges brought by Republican-led states. The program is meant to exempt more of a borrower's income from the monthly payment than previous plans and ensure interest does not accumulate beyond what a borrower can afford to pay each month.

Over the summer, a federal appeals court imposed an injunction on the program. Borrowers can still apply for SAVE but as a result of the injunction, servicers have temporarily paused processing applications.

<b>The deadline to apply for help with defaulted loans ends Wednesday</b>

Since student loan repayment resumed in October 2023, borrowers with defaulted federal student loans — meaning the borrowers failed to make a payment in 270 days or roughly 9 months — have been able to receive some help to prevent them from falling further behind.

The program known as Fresh Start spared defaulted borrowers from collection efforts, like getting their wages or tax refunds seized. Defaulted loans were also put back in "repayment" status and the record of defaulting was removed from their credit report.

Some benefits, like restoring access to federal student aid, were automatically applied to borrowers in default. But in order to gain permanent access to Fresh Start benefits, defaulted borrowers have to sign up before Wednesday morning.

To enroll, defaulted borrowers must first contact their loan holder. If their loans are held by the Education Department, they can sign up via mail, phone or online. The Education Department says the process should take about 10 minutes.

The federal government will start reporting delinquent payments to credit agencies

Another major change beginning Tuesday will be that student loan borrowers who miss a payment moving forward will likely see an impact on their credit report.

Over the past 12 months, the Biden administration did not report missed, late or partial payments to credit scoring companies in an effort to shield borrowers from the worst consequences of delinquent payments. That "on-ramp period" — as the Education Department calls it — is scheduled to stop at the end of Monday.

That means, as with the case before COVID, the federal government will resume reporting a delinquent payment once it is 90 days or more past due.