Caption

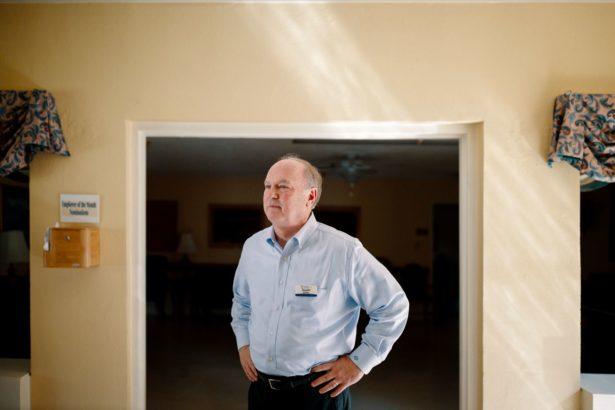

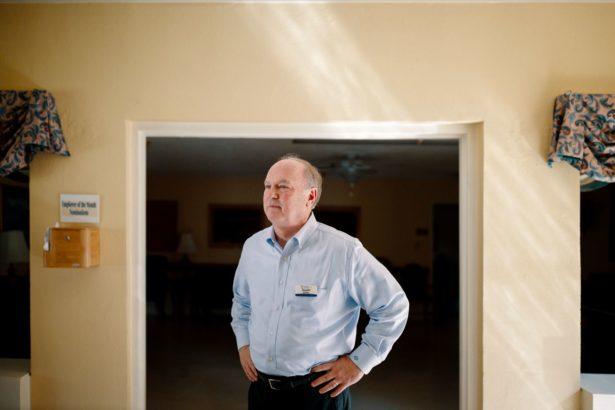

Ronnie Rollins attempted to upgrade his nursing homes with a controversial Medicaid loophole.

Credit: Melissa Golden

Ronnie Rollins attempted to upgrade his nursing homes with a controversial Medicaid loophole.

Nearly 20 years ago, Ronnie Rollins walked out of a hotel in Macon, Georgia, with an idea that he believed might lead the state’s struggling rural nursing homes to financial salvation.

State health officials had just told a conference filled with industry players about a federal program that would dramatically increase payments for care provided to nursing home residents. But there was a catch: To obtain the bonus money, the nursing home had to be owned by a public agency affiliated with a hospital.

Rollins owned a chain of nursing homes and didn’t seem to qualify for the program. But he dreamed up a workaround. His company had partnered with development authorities, which are designed to attract new businesses and jobs to counties, to secure tax-exempt bonds for its nursing homes. Rollins believed he could convince development authority officials to use their agencies to apply for those bonus payments from Medicaid. The idea hinged on convincing the federal government that the owners of the nursing homes were those agencies. Not his chain.

It was an unorthodox idea, he knew, one that pushed the limits of the law, and so Rollins asked Georgia’s Department of Community Health for an opinion. After a “healthy debate,” according to one former top official, DCH approved Rollins’ plan — so long as the department received a cut of the bonus payments. Department officials hoped to use the money to help stabilize Medicaid reimbursement rates for providers across the state.

National Guard members disinfect a room at a Dawson nursing home owned by Rollins, after a COVID-19 outbreak.

For Rollins, the idea paid off. Over nearly two decades, Rollins quietly built one of Georgia’s largest health care empires with the help of approximately $300 million in bonus payments under the federal program. In its 2002 fiscal year, his companies collected $20 million in total revenue. In its 2017 fiscal year, the companies in his nonprofit network, today called Community Health Services of Georgia, or CHSGa, recorded over $650 million in total revenue. Rollins’ network includes a company called Ethica, which includes 55 nursing homes, and related firms that supply the facilities with prescription drugs, health care supplies and medical transportation.

Rollins today is many things to many people. A hardworking businessman determined to improve nursing home care. A pickup-driving deacon in his hometown. A well-connected political donor whose investment company and corporate executives over the past decade donated more than $1 million to Georgia’s top Republican officials. One of the smartest men in the state when it came to taking advantage of the arcane policies of Medicaid and Medicare.

But, to the federal government, Rollins is the architect of a scheme that threatens Georgia’s ability to collect Medicaid funds.

“If you’re going to change things,” Rollins explained, “someone has to push the boundaries.”

Georgians may pay the price for his success, according to an investigation by Georgia Health News and ProPublica. The investigation is based on an analysis of state and federal health data, interviews with nearly two dozen people, government records, court filings and state agency emails obtained under Georgia’s open records act.

The Centers for Medicare and Medicaid Services, the federal agency responsible for America’s major public health care programs, ruled in 2014 that a portion of the bonus payments that flowed to Rollins’ chain were “inappropriate.” Payments under the program have halted, and CMS is now seeking $76 million in repayment from the state for the allegedly improper reimbursements.

Georgia’s Medicaid agency has appealed the decision, locking the state in an ongoing battle against the federal agency. If the appeal fails, taxpayers will be responsible for paying back the money, not Rollins.

The dispute has also reverberated beyond Rollins’ case to impact Georgians. Three top health care insiders contacted by GHN and ProPublica said that it has hampered the pursuit of innovative new proposals and delayed a Georgia-style Medicaid waiver, all of which could have secured millions of dollars for patient care services.

DCH officials declined requests for interviews, citing the ongoing dispute. In a letter from 2015, one top DCH official called the CMS findings “factually and legally incorrect.” A U.S. Department of Health and Human Services appeals board has not made a final decision.

Since CMS closed the loophole six years ago, Rollins’ Ethica nursing home network has been slapped with more than $1.2 million in fines for violating standards designed to keep patients safe. Some of those facilities have reported below-average staffing levels. From 2013 to 2018, the network recorded more than twice the number of deficiencies per nursing home than the average facility in Georgia.

The problems have continued during the pandemic: The COVID-19 death rate for the company’s 55 homes is 4.9%, compared with the statewide nursing home death rate of 3.3%, according to a data analysis of COVID-19 deaths and bed capacity conducted by GHN and ProPublica. At the Dawson Health and Rehabilitation Center, for instance, 14 of the 50 or so residents died from COVID-19 this past spring. Over half of Rollins’ 55 nursing homes have experienced coronavirus outbreaks, each of them with more than 30 residents testing positive.

Workers at a Rollins-owned hospice making gowns amid the pandemic.

In a series of interviews, Rollins said his nursing homes provided high-quality care. He pointed to awards given by industry associations, as well as internal data that showed Ethica had fewer deficiencies per survey than the national average since 2018. Ethica’s staff remains devoted to the fight against COVID-19 to keep patients safe during an unprecedented pandemic, he said. He declined to specifically address questions about the death rate in his homes.

Rollins defended his use of the CMS loophole, which he believed was legal and even approved of by federal officials, who had previously audited the program. While older nursing homes have at times lagged in patient outcomes, Rollins said his new and remodeled facilities have excelled. The loss of bonus federal payments, as he sees it, prevented Ethica from completing a systemwide overhaul improving senior care across Georgia.

Rollins’ idea, he said, offered a blueprint that would have finally given rural Georgia’s seniors the nursing homes they deserved. But the federal government stood in the way of those plans.

“We could’ve transformed long-term care,” Rollins said. “But we lost the ability to fulfill our mission.”

In the mid-1990s, Rollins realized that his for-profit nursing home chain, Care More, was headed toward financial doom. He had spent over a decade studying the ins and outs of Medicare, which primarily covered therapy, medications and other health care services in skilled-nursing facilities for the elderly. Rollins’ nursing homes, however, served rural Southerners who often qualified only for Medicaid, which had lower reimbursements than Medicare. After recession and war strained America’s economy in the ’90s, states froze their Medicaid reimbursement rates. His bank cut off Care More’s line of credit. He was running out of options. “I couldn’t make the numbers work,” he said.

America’s long-term care industry is largely propped up by government funding. For most of the country’s history, there was no health care system for elderly people facing chronic medical conditions. As average life expectancy increased over 50% during the early 20th century, so did demand for senior care services. The closure of poorhouses shifted that burden onto hospitals. So the hospital industry lobbied for a new kind of health system for older adults who were dependent on getting medical help but did not need acute care. The passage of Medicaid and Medicare in 1965 to provide care for the indigent and elderly led to the birth of the modern nursing home industry. It wasn’t long after that business started booming.

Congress intended for Medicaid’s costs to be split between federal and state governments. But in the 1980s, the Reagan administration slashed Medicaid. Suddenly stripped of federal money, cash-strapped states experimented with unconventional ways to obtain more money. That often involved looking for loopholes in the law. Daniel Hatcher, author of “The Poverty Industry: The Exploitation of America’s Most Vulnerable Citizens,” said states’ attempts to exploit such loopholes can undermine the broader intent of the nation’s massive public health insurance program.

It’s “a fundamental flaw of Medicaid,” Hatcher said.

At the hotel conference in Macon in 2001, Rollins listened to new money-raising ideas being promoted by the administration of then-Gov. Roy Barnes, a Democrat, who sought to increase health care services available to Georgians. Rollins received a packet of information explaining that state officials planned to raise the necessary funds through a “revenue maximization” campaign that would ensure that “all federal reimbursement programs … are utilized to the fullest extent possible.” One of the strategies that caught Rollins’ eye was known as the “Upper Payment Limit” program, or UPL, which effectively allowed government-owned nursing homes to receive matching federal bonus payments that closed the gap between Medicaid and Medicare reimbursement rates.

The UPL process is complex: A nursing home owned by a government agency wires funds to Georgia’s Medicaid agency; Georgia sends money to CMS; CMS returns the payment, along with a bonus amount, to Georgia; Georgia takes a cut of the bonus dollars and wires the rest back to the local agency’s nursing home.

The potential benefits to the state were clear: More than $80 million in federal dollars could flow to Georgia annually, allowing the state’s Medicaid agency to reinvest some of its money into health care reforms touted by Barnes.

Officials were so eager to get these dollars that they had even handed out spreadsheets listing how much money each hospital-affiliated nursing home could get. While exact figures depended on a variety of factors, reimbursement rates increased anywhere from 6% to as high as 180%. For instance, at one nursing home in south Georgia, the state projected that bonus payments would boost a $76 Medicaid reimbursement for a day’s worth of nursing home care into a $175 Medicare reimbursement — a 127% increase that translated into millions of dollars in extra revenue when spread across hundreds of patients.

If Rollins could convince the state to allow nursing homes owned by a development authority to secure bonus payments, the opportunity would be too good to pass up.

The first time Rollins visited his grandmother in a nursing home, his heart sank. The scents of urine, feces and bleach wafted through the halls past communal, cramped quarters. His grandmother was in a wheelchair as a result of breaking her knee in a fall. Rollins, the son of a south Georgia tobacco sharecropper, was in college. His family could not afford to send his grandmother to a nursing home with services like physical therapy. She would never walk again.

“I despised that nursing home,” Rollins said. “And I did not visit my grandmother like I should have because I didn’t like the place.”

As Rollins grew older, he came to see Georgia’s dilapidated rural nursing homes as a marker of the broader disinvestment in the state’s farming communities. So the man who despised nursing homes became an accountant for them, using his skills to understand the institutional forces that led to his grandmother not getting care. In the late 1980s, he became a part-owner of Care More’s nursing homes, and pursued reforms both conventional and unorthodox.

“If I was going to try to solve a problem in my life, this was the land of greatest opportunity,” said Rollins, now in his early 60s. “Did it pose some large obstacles? Yes.”

Whenever Rollins stepped inside a dilapidated, decades-old nursing home, he saw an opportunity to reinvent rural health care. The goal wasn’t just to have nicer nursing homes with newer amenities. The rebuilding of physical structures could attract qualified health care workers and provide more patients with private quarters. In turn, Rollins said, those changes could improve patient care outcomes, an idea supported by some medical experts and industry groups.

During a meeting with the Pulaski County Development Authority, Rollins agreed to keep nearly 300 jobs there in exchange for nearly $20 million in tax-exempt revenue bonds.

After state officials approved his development authority idea, Rollins persuaded local officials to support his cause. Around 2003, he drove over an hour west of his grandmother’s one-time nursing home to Hawkinsville, population 4,500, a quiet river town in rural central Georgia best known for its harness horse racing track and women’s state prison. He had recently acquired a nursing home and pharmacy group headquartered there, folding the companies under a newly formed nonprofit network that soon included Ethica nursing homes.

During a meeting with the Pulaski County Development Authority, Rollins agreed to keep nearly 300 jobs there in exchange for nearly $20 million in tax-exempt revenue bonds, issued by the authority and repaid with nursing home revenues. The deal was good for both sides. It provided better rates than a commercial loan, Rollins said. He would then offer the development authority the chance to get a cut of the proceeds from the bonus payments. All it required was for the authority to fill out paperwork and send funds to the state’s Medicaid agency, before a deadline.

Rollins hoped the bonus payments, along with tax-exempt bonds, would boost the fortunes of his nursing homes, which had a high number of Medicaid patients. Such nursing homes are more likely to have profit margins of less than 2%, according to the state’s leading nursing home association. “In Atlanta, there’s a lot of payer sources, but if you’re rural Georgia, you have Medicaid,” Rollins explained. “We’re at their mercy.”

At first, the Ethica network received minimal benefit. By late 2007, state records show that the 14 nursing homes affiliated with the Pulaski County Development Authority were collectively eligible for over $5 million in bonus payments each quarter. Rollins said Georgia’s Medicaid agency kept most of the bonus payments. CMS eventually proposed a rule that required providers to receive the full amount of the bonus payments. Federal officials never finalized the rule. But Georgia officials revised its Medicaid plan so that full payments went to providers.

The decision benefitted Rollins enormously. But some of his biggest competitors decided that going after the bonus payments was too risky a strategy.

“We did an extensive legal review, because if that money was available, we would love the resources as well,” said Neil Pruitt Jr., current chairman and CEO of PruittHealth, one of the South’s largest nursing home chains. “We determined that we couldn’t do it. It was a liability.”

Unfazed by the risk, Rollins overhauled his facilities thanks to the bonus payments.

Instead of taking out commercial loans, his companies paid cash for improvements like a $9 million, 32-bed addition at one nursing home in south Georgia and a $10 million expansion with a new Alzheimer’s unit at another home in the northwest part of the state. By the early 2010s, Rollins’ network had $47 million in construction projects happening simultaneously.

Rollins at Gray Health and Rehabilitation, a nursing home replaced by a newer facility.

Putting the money toward buildings was perfectly legal. MACPAC, a nonpartisan legislative branch agency that analyzes Medicaid policy, has opined that bonus UPL payments do not have to be “directly related to specific Medicaid services or patients.”

The money from the bonus payments allowed Rollins’ companies to pour additional money into his health care system. He launched companies that supplied his nursing homes with prescription drugs, medical transportation and health care supplies. As one former employee put it, “they were HUGE cash cows” that allowed the network to lower costs paid to outside companies. It also freed up enough cash to help the network purchase businesses that owned hospices, home health services, ambulances and a 90-bed rural hospital. Rollins’ executives even had enough resources to give gifts of Waterford crystal to top employees and go on expenses-paid Royal Caribbean cruises for “team-building” trips, multiple employees said in sworn depositions for a lawsuit against one of Rollins’ nonprofits.

From 2002 to 2013, Ethica-affiliated companies grew their net assets from $17 million to $297 million. That final year culminated with total revenues of approximately $500 million, which, after expenses, resulted in a 7% profit margin. That success didn’t benefit development authorities as much, who generally received less than 1% of the funds that moved through the agencies’ accounts.

Gerald Beckum, the current head of the development authority in Macon County.

At least nine public agencies — mostly development authorities — moved funds for Rollins’ network to obtain bonus Medicaid payments for Ethica nursing homes. They did little else, even though, on paper, they were the owners of the nursing homes. For instance, most of the authorities did not require Rollins’ companies to meet specific health care benchmarks.

Rollins said the payments were justified because of the jobs created or preserved. “No one ever turned down anything,” he said.

But Gerald Beckum, the current head of the development authority in Macon County, said such authorities rarely hire lawyers specializing in bond financing because of their limited resources. Limited oversight follows, he said.

Beckum, who took over the authority in 2015, never dealt directly with Rollins. But the arrangement struck him as strangely complex.

“Not everyone understands this system,” Beckum told GHN and ProPublica. “Some people understand the system too well — and figured out how to take advantage of it.”

Rollins’ loophole caught the eye of federal health officials, who sometime around 2013 discovered that millions of Medicaid dollars had passed through a tiny agency that claimed to own nearly as many nursing homes as there are in the entire state of Alaska.

When a CMS investigator asked Pulaski County officials about the 14 nursing homes they claimed to own, the answer was puzzling: Local officials told the investigator that the development authority “does not own any nursing facilities.” The authority’s state filings further confirmed it did not own any land or buildings. Yet it was sending money to Georgia’s Medicaid agency that made it appear, for purposes of the bonus payments, as though it were an owner of the nursing homes.

Georgia State Capitol

More baffling was that none of the nursing homes was actually in Pulaski County. Some were in nearby counties, but most operated in faraway towns that are small dots on a Georgia map: Butler and Barnesville; Leesburg and Lyons; Waverly Hall and Waynesboro.

Then there was the money flow. The development authorities in Pulaski County and elsewhere received payments that traced back to a Rollins nonprofit called Health Scholarships, which was originally created to provide nurses with grants to further their education. Bank records showed that Pulaski County had received $35,000 for wiring nearly $14 million over a two-year period. Adding it all up, the CMS investigators determined that Rollins had convinced development authorities across the state to help collectively obtain tens of millions of dollars in bonus payments since the state approved the loophole.

In December 2014, CMS published its draft report. It did not contain good news for Rollins or for Georgia.

Federal officials ordered Georgia’s Medicaid agency to “immediately cease and desist” the use of development authorities to obtain bonus payments. One of the reasons: Federal officials did not believe the development authorities to be the true owners of the nursing homes under investigation.

The state faced a $76 million clawback, a requirement to return money to the federal government, for extra payments obtained through “inappropriate sources,” the report said.

Rollins used his influence to fight back. A political donor who, along with corporate executives, gave $200,000 to state GOP races from 2010 to 2014, Rollins secured a seat on then-Gov. Nathan Deal’s rural hospital stabilization committee, and he had established a direct line of communication to the governor’s top health officials.

Rollins sent a memo to Clyde Reese, commissioner of DCH, and Deal’s chief of staff. Rollins described the findings as “deeply flawed.” He wrote that CMS had previously approved the state’s UPL payment plans, and he claimed the federal agency had erred in its interpretation of Georgia laws.

Rollins secured a seat on then-Gov. Nathan Deal’s rural hospital stabilization committee, and he had established a direct line of communication to the governor’s top health officials.

“This is the greatest issue to ever face our organization,” wrote Rollins, who pleaded with Reese to challenge the ruling.

Reese ordered his staff to craft a “very aggressive” response to CMS, hoping to convince the agency to reconsider the clawback. In February 2015, DCH sent CMS a strongly worded letter that included several points raised by Rollins in his memo, noting that the loophole had been cleared through previous federal audits. “CMS’ ruling is factually and legally incorrect,” wrote Reese, who declined to comment for this story.

Despite Reese’s defense, the clawback nevertheless weighed on the mind of his boss.

“Any time you’re talking about those kinds of dollars,” Deal told reporters in April 2015, “there has to be concern.”

Two days before Thanksgiving 2018, CMS denied Georgia’s appeal, rejecting its arguments that 34 nursing facilities involved in the loophole’s use were publicly owned. CMS noted that the funding used to obtain the bonus dollars originated from Ethica-affiliated companies. Georgia’s Medicaid agency appealed the decision and the case now lies with the U.S. Department of Health and Human Services Departmental Appeals Board. A CMS spokesman declined to comment since the case is still pending.

In recent years, other states with bonus payment disputes have not had great luck before the HHS board. In 2016, Alabama was ordered to pay back $72 million intended for rural nursing homes owned by public hospitals, but that the state mostly kept for itself. In 2018, Texas had to pay back $25 million in a dispute over two private hospitals moving money through county hospital authorities to initiate the bonus payments.

Georgia’s ongoing dispute has rippled out, affecting other providers statewide. At least three health care industry insiders told GHN and ProPublica that the state’s hard-nosed defense of the bonus payments has hindered its ability to work with CMS on other initiatives. DCH officials have warned advocates against exploring creative strategies to secure more federal health dollars. The timing wasn’t right, with the bonus payments case still in limbo, they said. Others worried the dispute slowed the state’s efforts to allow more people to qualify for Medicaid. “DCH was reluctant to try new Medicaid financial strategies,” one source told GHN and ProPublica.

Beckum, the head of Macon County’s development authority, received a call just last year from an HHS attorney about the dispute. The attorney, Kathleen Duffield, who advised HHS on issues of fraud, waste and abuse, declined to comment.

The investigation has rattled some development authorities, too.

Beckum, the head of Macon County’s development authority, received a call just last year from an HHS attorney about the dispute. The attorney, Kathleen Duffield, who advised HHS on issues of fraud, waste and abuse, declined to comment. But records obtained from multiple development authorities show that she had asked for more records beyond the initial scope of the 2013 investigation.

Beckum, a former Georgia secretary of state candidate who started his new job after CMS closed the Medicaid loophole, was concerned enough about the call to research the bonus payments before sending records to Duffield. The complexity of the Medicaid payment arrangement left his head spinning — a sign that few there actually grasped what the authority was doing. While he understood that rural officials desired to secure jobs for their constituents, he wondered if they had any idea about what had happened.

Rollins said that state officials have never asked him to pay back the $76 million. Nor does he expect them to. The dispute occurred between the two government agencies, he said. In the grand scheme of Medicaid, Rollins said, $76 million was ultimately a small figure for two multibillion-dollar agencies. DCH declined to comment on the matter, citing the pending litigation.

But several lawmakers, lobbyists and policy experts expressed concerns about Georgia’s ability to absorb the potential hit with COVID-19 forcing budget cuts to state agencies.

“This couldn’t come at a worse time for the state’s fiscal situation with revenues cratering from COVID-19,” said Erin Fuse Brown, a law professor at Georgia State University.

Today, Rollins has largely abandoned his pursuit of the bonus payments from Medicaid. Backhoes stopped moving dirt as much. Rollins asked his board to cut his $1.3 million salary.

“I felt like I had failed,” he said. “I felt personally responsible” — and, with development halting — “I felt it was the right thing to do.”

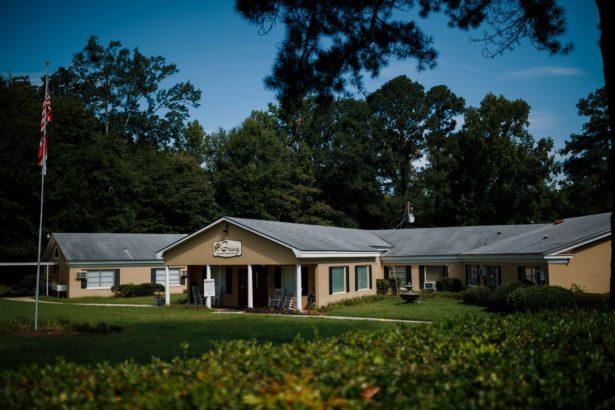

Gray Health and Rehabilitation.

He takes an obvious pride in what Ethica has been able to accomplish. During a tour with GHN and ProPublica on a sweltering morning in early August, Rollins unlocked the doors of a low-slung beige building a short drive north of Macon. The 58-bed Gray Health and Rehabilitation nursing home, which received bonus payments, had sat empty for months. As he stepped through the halls, Rollins noted the flaws of the shuttered nursing home, from shared rooms split by curtains, to window air conditioner units that offered poor ventilation.

Afterward, he showed off Autumn Lane Health and Rehabilitation, a new $12.4 million, 85-bed nursing home that replaced Gray Health and Rehabilitation. Rollins walked the perimeter because anyone who wasn’t essential staff — himself included — was prohibited from going inside. A “virtual tour” on the facility’s website boasted of a “warm and inviting decor,” “home-like settings for therapy sessions” and private bedrooms. Those upgrades were the kind that Rollins sought to make at dozens of his nursing homes if the loophole remained open.

“Our country and state needs significant change in nursing facilities — funding for private rooms, building infrastructure,” Rollins said after the tours. “COVID-19 would be a much lesser issue today if we did what we advocated. We can’t correct the past.”

COVID-19 has sharpened focus on the care provided by Rollins’ nursing homes. During the pandemic, Ethica nursing homes experienced major shortages of personal protective equipment, forcing staffers to make 15,000 pieces of gear from scratch — including gowns made from plastic sheets. Rollins said Ethica’s nursing homes are following Centers for Disease Control and Prevention guidelines for infection control. But nearly 17% of the more than 1,500 residents who tested positive at Ethica nursing homes have died, according to an analysis of state records.

Sixty percent of Ethica’s COVID-19 cases have occurred in 15 nursing homes. Besides the facility in Dawson, where nearly a quarter of the residents died in the first two months of the pandemic, they include a nursing home in Richland, where nearly every resident contracted COVID-19. The staff of Bolingreen Health and Rehabilitation in Monroe County, where nearly 50 residents tested positive for COVID-19, was the subject of an Occupational Safety and Health Administration complaint that accused Ethica of “not effectively developed or implemented an infectious disease preparedness and response plan.” (OSHA has not posted its final determination on its website. Rollins declined to answer questions about it.) Not only did those nursing homes once receive bonus payments, they had never been rebuilt. Rollins said the bonus payments ultimately paid to renovate or rebuild about a dozen nursing homes.

“Our new facilities generally have not had issues with COVID-19,” Rollins said. “They have modern air ventilation systems and are designed to facilitate staff segregation in units. So if there’s an outbreak, it’ll be more limited and contained.”

Autumn Lane Health and Rehabilitation.

Most Ethica nursing homes with COVID-19, however, have yet to be renovated.

Arthur Daniels, an 86-year-old deacon who liked to sing gospel songs, was living in an outdated nursing home when the pandemic arrived. Last fall, Daniels was admitted to Sparta Health and Rehabilitation, a 81-bed facility in the rural town of Sparta, population 1,400.

The longtime coach of Hancock Central High School’s basketball team, Daniels was best known for convincing twin brothers Horace and Harvey Grant to play basketball. The Grants eventually grew to over 6’8,” played college hoops and were both drafted into the NBA. Horace, an all-star, won three championships with the Chicago Bulls in the 1990s.

The Sparta nursing home had once benefitted from the Medicaid loophole thanks to the Pulaski County deal. But it never got renovated. It now has staffing rates, along with patient care measures such as rates of residents who were hospitalized or injured by falls, that are worse than the national average reported to Medicare. Daniels visited with his longtime friend, Dianne Huffman, every other day until Georgia officials restricted nursing home guests. This past May, COVID-19 spread through the nursing home. Thirty-three staff members and 59 residents tested positive. Nineteen residents, including Daniels, died from COVID-19.

At a socially distanced funeral, Nathaniel Snead, the pastor of Daniels’ church, read a passage from the Bible that connected Daniels’ life to the pandemic that had torn through Georgia, Sparta and the nursing home owned by Rollins. “You don’t know whom God will keep here and how long he will keep us here,” Snead said. “To keep you here is going to take more than a mask.”

Shortly after showing off Ethica’s Autumn Lane nursing home, Rollins was asked what he’d tell the families of patients like Daniels. He stared off into the distance, holding back tears. After nearly a minute of silence, he mentioned Oxley Park Health and Rehabilitation, the nursing home where his grandmother once stayed, which he now owned. His brother-in-law currently lived in the same home and had recently tested positive for COVID-19. Rollins explained: “In rural communities like where I’m from, and where my family is located, it’s been especially difficult. The choice is: Do you stay [at home] in the community, where you know there’s active cases, or do you remain in the nursing facility?”

Rollins’ family ultimately decided it was safest to keep his brother-in-law at Oxley Park. It happened to be one of the facilities Rollins had managed to upgrade before the loophole closed. State records showed that 40 people had tested positive for COVID-19. Thirty of those people have since recovered. His brother-in-law survived. (Three residents have died.)

Rollins once envisioned similar upgrades in Sparta. But with the loophole closed, his dreams were deferred. He now thought about the families of the deceased and what he might say. Having collected his thoughts, he looked up and offered a brief explanation: “We did the best we can do.”

This story comes to GPB through a reporting partnership with Georgia Health News.

This article was produced in partnership with ProPublica, a nonprofit newsroom that investigates abuses of power. Georgia Health News is a member of the ProPublica Local Reporting Network.

About the data: Georgia Health News and ProPublica collected COVID-19 data compiled by the Georgia Department of Community Health. The department requires long-term care facilities with 25 or more beds to report figures on positive cases among patients and staff members, patient deaths, and resident censuses. To calculate the death rate, we divided the number of deaths by bed capacity, as the state only reports resident census figures for homes that experienced outbreaks.