Concept 38: Trade Barriers

Overview: Most economists agree that trade is good and free trade is even better. If that's the case, why - and how - do almost all nations try to limit it? This lesson explains.

Learn

Beginner

Most economists agree that free and open trade benefits all countries that participate. Sometimes, however, countries believe it is to their advantage to restrict trade with other countries. Usually this results from a desire to show preference to domestic industries or to punish other countries for some political or economic reason. When countries desire to limit trade with another country or group of countries, they do so by erecting a trade barrier. Trade barriers take many forms but the most common are these:

- Tariffs are a tax on imports. They operate by imposing an extra cost, or tax, on each unit of some specific good that is brought into a country from the targeted country. In March 2018, the United States placed a 25% tax on imported steel from most countries to encourage steel consumers to buy from U.S. companies.

- Quotas are a limit on the number of a certain good that can be imported from a certain country. For example, the U.S. might limit the number of Japanese cars that can be imported to 1 million units.

- Embargoes occur when one country bans trade with another country. This can be limited to one specific good like oil or can include all goods from a specific country. Embargoes are relatively rare, but the U.S. imposed a trade embargo on Cuba in 1962.

- Standards involve making sure that all goods imported from a country or region meet specific criteria. The criteria may relate to health and safety issues, like not allowing the use of certain pesticides, or require certain labor conditions or ban products containing materials like ivory.

- Subsidies are a direct payment from a government to industries within their own country. For example, farmers might receive financial help from the U.S. government to make sure they can grow crops at a competitive price.

Intermediate

Trade barriers are often enacted to protect industries and workers within a country. This is referred to as protectionism. For example, tariffs, quotas and embargoes make foreign goods more expensive and less available. Goods produced domestically, which are exempt from the barriers, are more competitive in this environment. Subsidies protect domestic industries by giving them direct payments to help them lower production costs. Trade barriers allow domestic industries to survive and compete with foreign producers that might be able to produce a good at a lower cost.

There are some compelling reasons to enact trade barriers. Sometimes they are used by countries to encourage and protect domestic industries that are just developing and that will take some time to become globally competitive. Other times they are used to punish countries for unfair trade practices such as intellectual property theft or distributing unsafe products. But trade barriers have costs as well, making foreign goods more expensive and less available for domestic consumers who may prefer them. Additionally, trade barriers may stifle domestic innovation and efficiency by limiting the foreign competition that domestic industries must face.

There are also very significant reasons not to enact trade barriers. Sometimes trade barriers are put in place simply as political favors. These barriers often have little economic principal behind them. Barriers like subsidies can also artificially lower the global price of goods and services to a point that drives some producers out of business. Once enacted, trade barriers can be extremely difficult to remove because the industries protected have high incentives to keep them in place.

Advanced

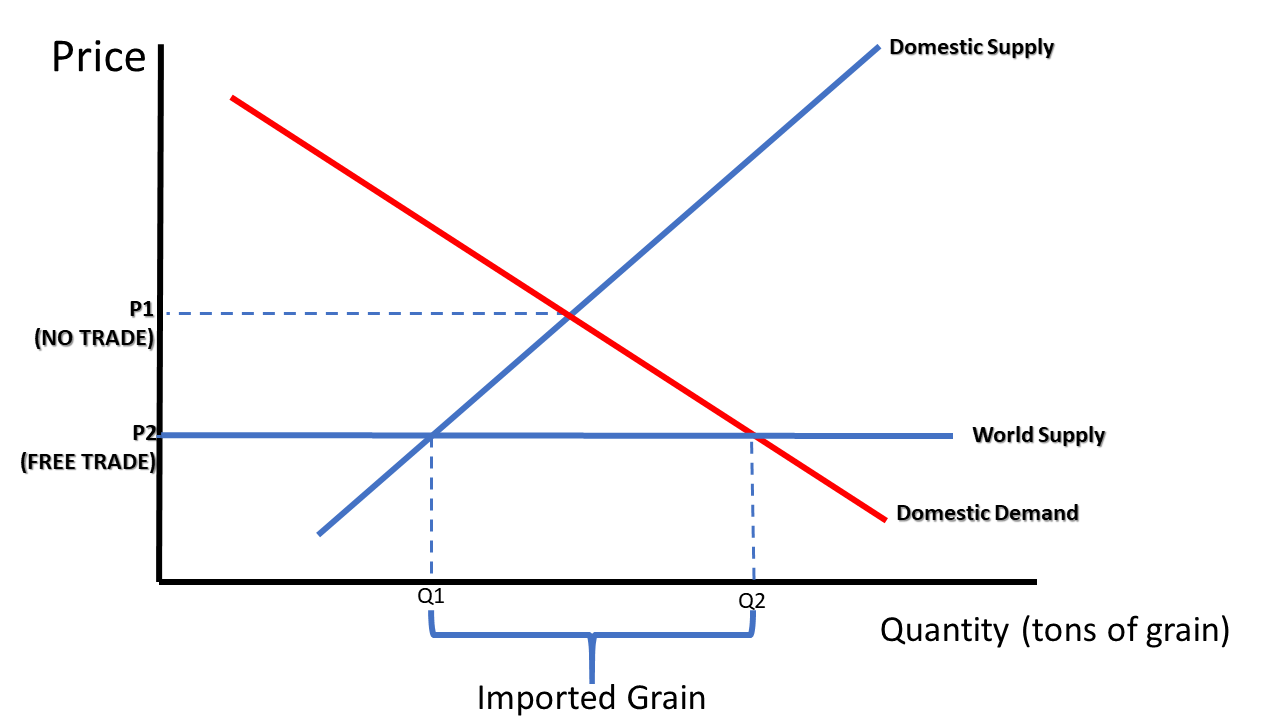

Trade barriers can be shown graphically. Graph 38-1 shows a market for grain in free trade. With no trade, the market price of grain would be P1. Because of free trade, however, the global price is P2 and the quantity of grain between Q1 and Q2 is imported. Consumers get more grain at a cheaper price. However, domestic producers of grain cannot compete as well at that low price.

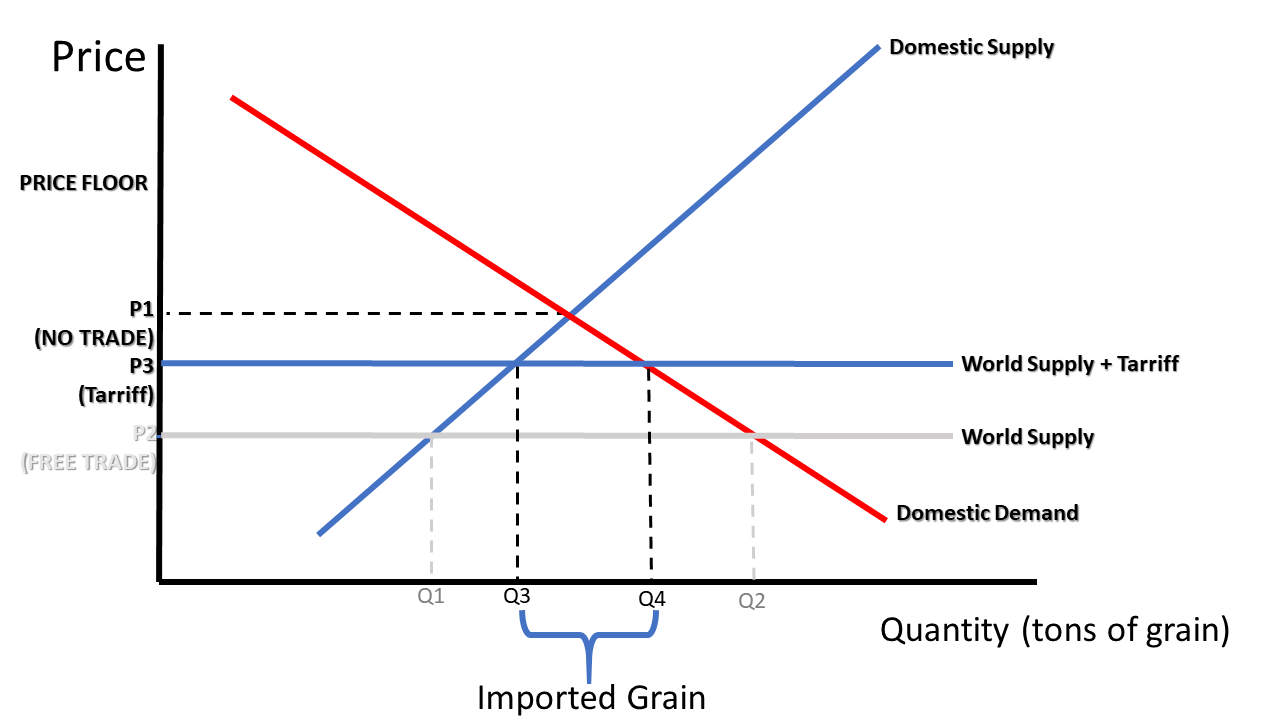

If the producers successfully lobby for a tariff, then a tax will be placed on imported grain, thus raising the price of world grain. Graph 38-2 demonstrates the effects of this tariff. Now, the price of the grain in this country is P3. At this price, more producers are willing and able to provide grain and the quantity of grain imported shrinks to the difference between Q4 and Q3. You may also observe that at the higher price consumers will purchase less grain. For more on why this occurs, please visit Concept 17 – the Law of Demand.

Click a reading level below or scroll down to practice this concept.

Practice

Assess

Below are five questions about this concept. Choose the one best answer for each question and be sure to read the feedback given. Click “next question” to move on when ready.

Social Studies 2024

Explain how trade barriers create costs and benefits to consumers and producers over time.