Section Branding

Header Content

Legal fights and loopholes could blunt Medicare's new power to control drug prices

Primary Content

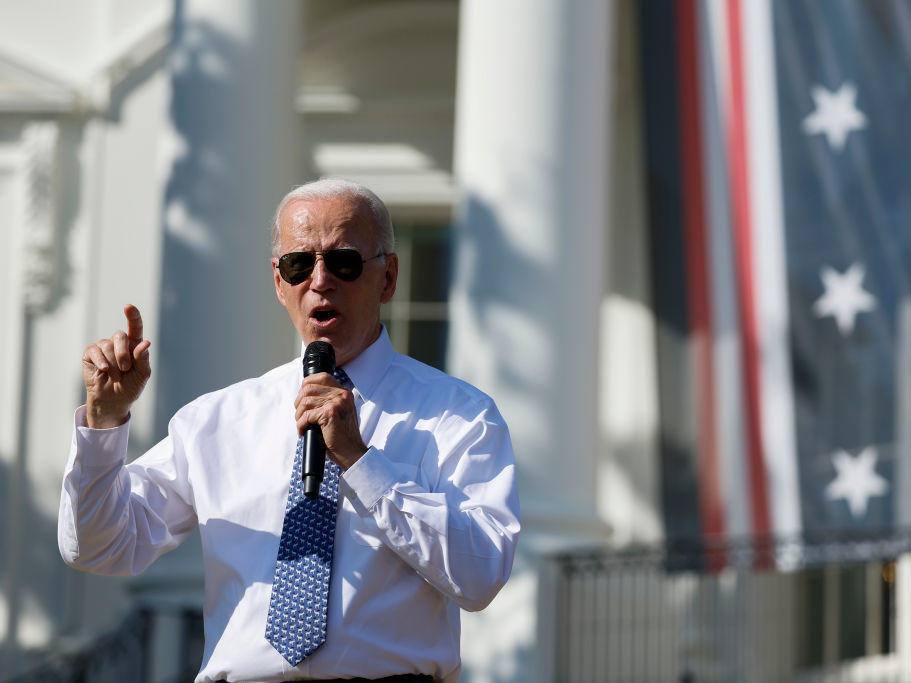

On Tuesday, the White House celebrated the passage of the the Inflation Reduction Act, a sweeping climate, tax and health care package passed in August. Among other measures, it grants Medicare historic new powers to control prescription drug prices.

Democratic leaders like U.S. Sen. Chuck Schumer, D-N.Y., celebrated what they see as one of the law's historic achievements. "For years, the naysayers said we could never take on the big drug companies and lower prescription drug costs but we did, and we won," Schumer said.

But for the people faced with putting this law into practice, the work is just beginning. Now, federal government employees and pharmaceutical companies begin a new round in the fight over how much the massive Medicare program pays for prescription drugs.

This round is shaping up to be a bureaucratic brawl over the new law's fine print, its loopholes and its legality. Here's what's at stake and what stands in the way of Medicare benefiting from the new measures.

Medicare's new powers to cut and cap prescription drug prices

Two of the biggest battlegrounds will be a pair of new powers that lawmakers gave Medicare, the federal insurance program that covers 64 million seniors and people with disabilities. Medicare's roughly $180 billion annual drug budget accounts for more than a third of the country's total drug spending.

One of the new powers lets the federal government negotiate deep discounts directly with drugmakers for some of the drugs that cost Medicare the most. This provision is unprecedented — and one that the pharmaceutical industry fought for decades.

To be eligible for negotiation, drugs must be among the 100 products costing Medicare the most money, have been on the market at least several years, lack generic competition, and be unaffected by several other exemptions in the law.

Despite those caveats, Medicare can still target some of the industry's biggest moneymakers, like Eliquis and Xarelto, a pair of blood thinning medications that Medicare spent $10 billion on in 2020 and Januvia, a diabetes drug that racked up nearly $4 billion in Medicare sales that same year.

Medicare will announce its first 10 targets next September and the prices negotiated for those drugs will take effect in 2026. The law allows Medicare to target additional drugs each year thereafter, adding up to as many as 60 by the end of this decade.

The other new power lawmakers gave Medicare is known as the inflation rebate. It does have precedent. Medicaid, which covers 82 million low-income Americans, has used its inflation rebate power for 30 years. It allows Medicaid to claw back any price increases that exceed the rate of inflation, and has significantly lowered Medicaid's spending.

This provision, which applies to most drugs, now allows Medicare to do the same. It takes full effect in 2023, with Medicare planning to collect rebate payments for some drugs as soon as April.

Drugmakers often hike product prices in January, so executives will be facing some important pricing decisions very soon, said Sean Dickson, health policy director for the West Health Policy Center, a nonpartisan organization focused on lowering health care costs.

Numbers released last week by the Congressional Budget Office estimate that together this pair of provisions would save Medicare about $170 billion over the next decade. But those savings are far from guaranteed.

More lobbying and lawsuits likely

Although the Inflation Reduction Act is now law, many of its crucial details still need to be filled out. That process, known as rulemaking and guidance, is where experts expect the pharmaceutical industry to shift its lobbying effort.

Many seemingly technical details could have major implications on this law's impact. For example, the text of the Act does not clearly outline how a negotiated price will be calculated if bargaining between a drugmaker and Medicare ends in a stalemate.

Mark Newsom, a policy consultant who worked at the Centers for Medicare and Medicaid Services for several years, including in 2004 when Medicare underwent major reforms, expects the drug industry to apply heavy political and legal pressure on this rulemaking process.

Numerous experts say they expect to see lawsuits challenging provisions of the law. One legal target could be a massive tax penalty for companies who refuse to cut Medicare a deal.

"They're going to go to the Hill and ask for legislative change, or they're going to go to the courts and they're going to litigate," Newsom said.

Taking advantage of the law's vulnerabilities

At the same time, the drug industry is also laying plans for a world in which Medicare's new powers do survive. "They are absolutely preparing for implementation," said Alice Valder Curran, who advises drug companies on pricing strategy at the law firm Hogan Lovells.

There's plenty of evidence from Medicaid's 30 years of implementing inflation rebates showing how drugmakers work around the system.

"There's a long track record of manufacturers taking creative strategies to avoid paying these rebates," said Dickson of West Health Policy Center who previously advised drugmakers on compliance with government pricing rules.

Occasionally, companies blatantly break the rules, as evidenced in a recent $233 million settlement between the Department of Justice and drugmaker Mallinckrodt. Far more often, though, said Dickson, companies take advantage of the rules, exploiting vague definitions, flawed formulas and other loopholes in the rebate law.

One area ripe for gaming is the formula known as average manufacturer price that Medicaid uses to determine whether companies owe money for hiking prices faster than inflation. The law gives companies ample discretion in how they calculate that average, and firms have used that discretion to include or exclude certain sales to avoid triggering rebate payments. Just one loophole in that formula, which Congress closed in 2019, had cost Medicaid at least $595 million per year in lost rebates, according to a report by the Office of Inspector General for the U.S. Department of Health and Human Services.

The Inflation Reduction Act essentially duplicates the language of Medicaid's inflation rebate law, making Medicare now vulnerable to the same loopholes. And drugmakers have much more incentive to exploit them, said Dickson. Companies make three times the revenue from Medicare than they make from Medicaid.

"It's a constant effort to keep churning through and finding where those vulnerabilities lie," said Amber Jessup, the chief health care economist at the Office of Inspector General for the Department of Health and Human Services, which monitors federal health programs for fraud, waste and abuse. Jessup added that it is too soon to know whether similar vulnerabilities might lie within the negotiation provision of this new law.

She said that her team of auditors, analysts, evaluators and lawyers feel the weight of this new challenge. "There are a lot of health care dollars at stake."

Preparing for the unprecedented

Whatever conflicts lie ahead, the Inflation Reduction Act will usher in sweeping change in how Medicare pays for prescription drugs. "It transcends any of the other pricing reforms I've ever seen, because it is so expansive," said industry advisor Alice Valder Curran.

That expansiveness has made the law's longer term implications difficult to ascertain, especially for large pharmaceutical companies with hundreds of products on the market, each priced and paid for in different ways. "We're really still in the discovery phase," Curran said.

Other industry experts expect companies to consider a variety of responses to the law to make up for losses in their bottom line, including charging private insurers more or hiking the launch prices of future drugs — an area not regulated by this law.

About the only thing certain this early in the implementation of the new law is that drugmakers and the government officials who regulate them are both hurtling toward a new frontier. The race to map it, navigate it and thrive in it has just begun.

This story was produced by Tradeoffs, a podcast exploring our confusing, costly and often counterintuitive health care system.

Copyright 2022 NPR. To see more, visit https://www.npr.org.