Section Branding

Header Content

Tesla bounces back after a production slowdown

Primary Content

Elon Musk is confident the end of year for Tesla will be "epic" because electric vehicles are more desirable amid unstable gas prices, the CEO said on a call with shareholders and analysts.

Tesla reeled in over $21.5 billion total revenue from the fiscal quarter ending in September.

That's up from $17 billion the prior quarter when the company saw a weeks-long factory shutdown in Shanghai due to COVID-19 this spring. But total revenue still fell short of analysts' expectations and Tesla stocks saw a slight dip.

Musk and the company are heading into the rest of the year with something to prove: that people still want to buy their cars despite production backlogs and signs of slowing demand amid fears of recession.

"For the first time after a Cinderella story, the company's hitting some challenges, and investors need to have some comfort in this white-knuckle backdrop," said Daniel Ives, a managing director and technology analyst at the investment firm Wedbush Securities.

That comfort could come in the form of a stock buyback. On the call Musk teased just such a possibility — where a company buys its own shares after a period of growth. He said it's possible "even in a downside scenario" as an incentive for investors who stay for the long haul. Buybacks normally boost stock prices.

Investors are particularly worried about China, one of Tesla's largest markets, where Chinese electric vehicle manufacturing companies such as BYD and XPeng have ramped up domestic production and become stronger competitors.

"While market trends will run short term, it's very important to focus on the long term," said Musk.

Tesla produced over 365,000 vehicles and delivered 343,000 cars to customers in the quarter — up from 258,000 and 254,000, respectively in the prior quarter.

"We have excellent demand for Q4," said Tesla CEO Elon Musk on a call with investors and analysts Wednesday. "We expect to sell every car that we make."

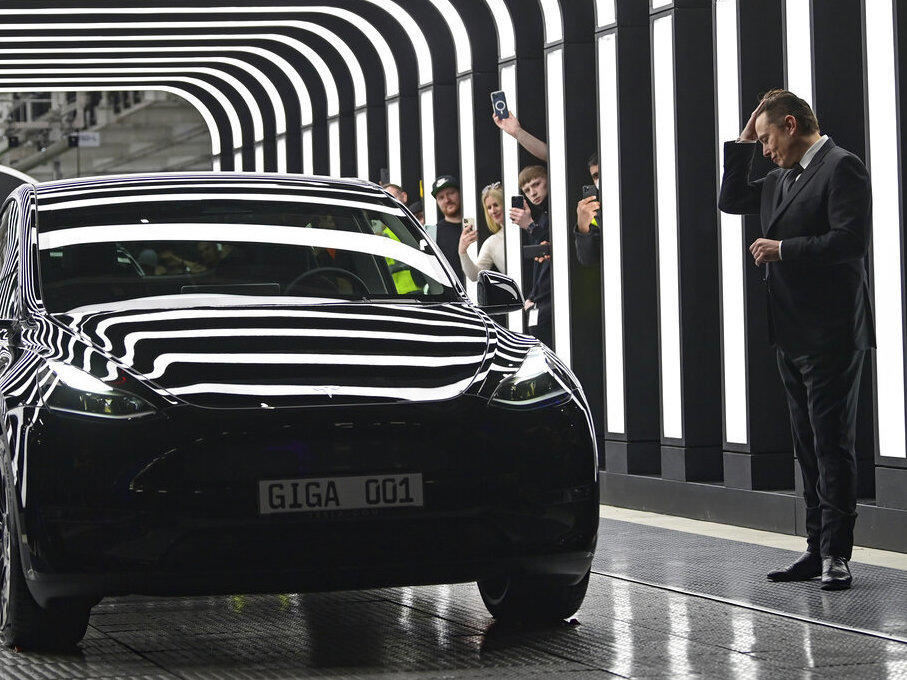

Tesla opened its first factory in Europe — "Gigafactory" Berlin-Brandenburg — in Germany in March but has since paused expansion as the Biden administration is promising incentives for electric automakers in the U.S. Europe is also facing a serious energy crisis that could worsen as demand for electricity and heat skyrockets over the winter.

There are also outstanding questions about whether Musk will choose to sell more of his own Tesla shares as the tech executive remains embroiled in high-stakes negotiations with Twitter after agreeing to buy the platform for $44 billion.

Copyright 2022 NPR. To see more, visit https://www.npr.org.