Section Branding

Header Content

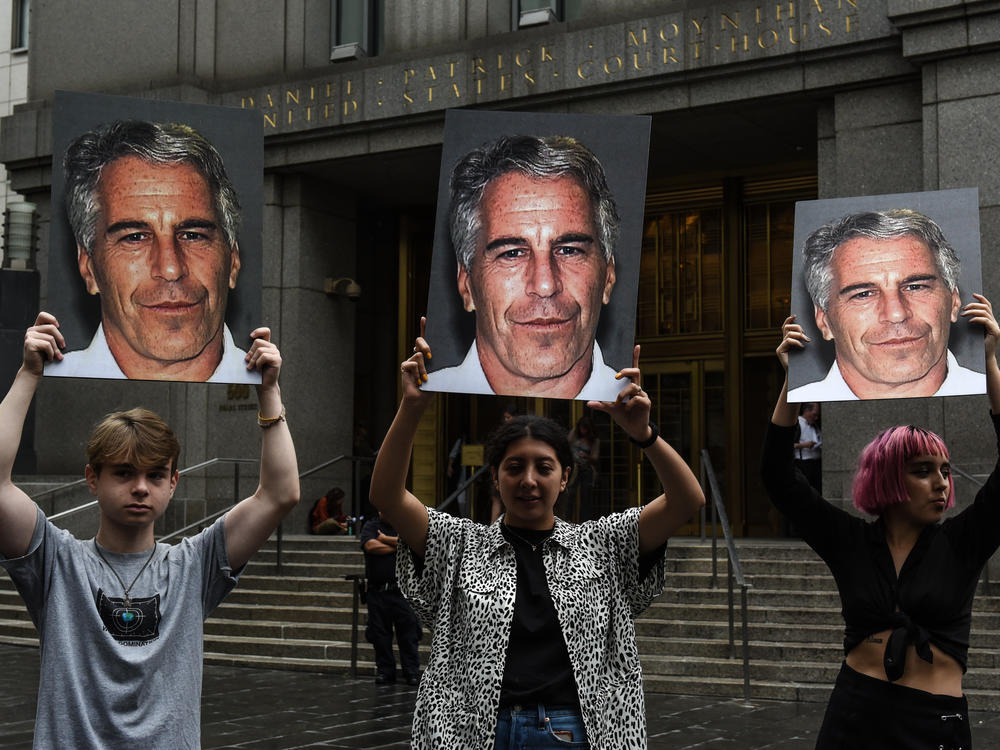

Can banks be sued for profiting from Epstein's sex-trafficking? A judge says yes

Primary Content

A trio of lawsuits filed against two banks connected with Jeffrey Epstein can move forward, a federal judge ruled on Monday.

The suits allege that JP Morgan Chase and Deutsche Bank knew that Epstein maintained a network of underage girls for sexual abuse, and actively enabled him to continue his crimes. The plaintiffs say that the banks should be held fiscally liable for the damage to victims.

Two of the suits — one against JP Morgan Chase and the other against Deutsche Bank — were brought by at least one of those girls, an anonymous plaintiff who filed on behalf of "all others similarly situated."

A third suit was filed by the government of the U.S. Virgin Islands against JP Morgan Chase.

A federal judge partially denied a motion to dismiss the lawsuits

On Monday, a federal judge with the Southern District of New York granted only parts of a motion to dismiss the three lawsuits.

Judge Jed S. Rakoff did not explain his reasoning for granting a collective total of 17 of the motions between the three lawsuits, saying an opinion on the reasoning would "follow in due course." The original motion to dismiss has been sealed.

However, Raskoff denied other claims made in the motions to dismiss, which allows the suits to move forward to examine other legal questions, including:

- whether the banks knowingly benefited from participating in a sex-trafficking venture

- whether the banks obstructed enforcement of the Trafficking Victims Protection Act

- whether the banks negligently failed to exercise reasonable care to prevent harm

When contacted by NPR, both JP Morgan Chase and Deutsche declined to comment on the ruling. Both banks have denied having knowledge of Epstein's alleged crimes.

Epstein, a financier and friend to prominent figures such as Donald Trump and Bill Clinton, was found dead in his prison cell in 2019 while awaiting the start of a trial over sex-trafficking charges.

He'd previously served 13 months in jail after pleading guilty in 2008 to Florida state charges of procuring an underage prostitute. The case had been well-documented by local and national media.

JP Morgan Chase CEO 'knew in 2008' that Epstein was an abuser, a lawyer argued

In January, JP Morgan Chase tried to shift the blame for its ties to Epstein by filing a lawsuit against one of its former executive, Jes Staley.

The suit denies that JP Morgan Chase had knowledge of Epstein's alleged crimes and says that if the company is found responsible for damages, Staley should be liable for a percentage of those damages.

Staley exchanged roughly 1,200 emails with Epstein from his JP Morgan Chase account between 2008 and 2012, according to court filings. Epstein had over $120 million in assets with the bank at the start of that period.

The anonymous plaintiff behind one of the JP Morgan Chase cases alleges that Staley "knew without any doubt that Epstein was trafficking and abusing girls," having witnessed some of the abuse personally.

After leaving JP Morgan Chase in 2013, Staley went on to become chief executive of the British bank Barclays. He stepped down in 2021 when regulators disclosed his ties with Epstein during a preliminary investigation. The regulators gave no findings about whether Staley knew of Epstein's alleged crimes.

Mimi Liu, an attorney for the U.S. Virgin Islands, pushed back against the company's move to shift focus to Staley. During a hearing on Friday, she said that current JP Morgan Chase CEO Jamie Dimon also knew of the abuse.

"Jamie DimonJ knew in 2008 that his billionaire client was a sex trafficker," Liu said, according to CNBC. "Staley knew, Dimon knew, JPMorgan Chase knew."

A transcript of the hearing has not yet been made public.

Copyright 2023 NPR. To see more, visit https://www.npr.org.