Section Branding

Header Content

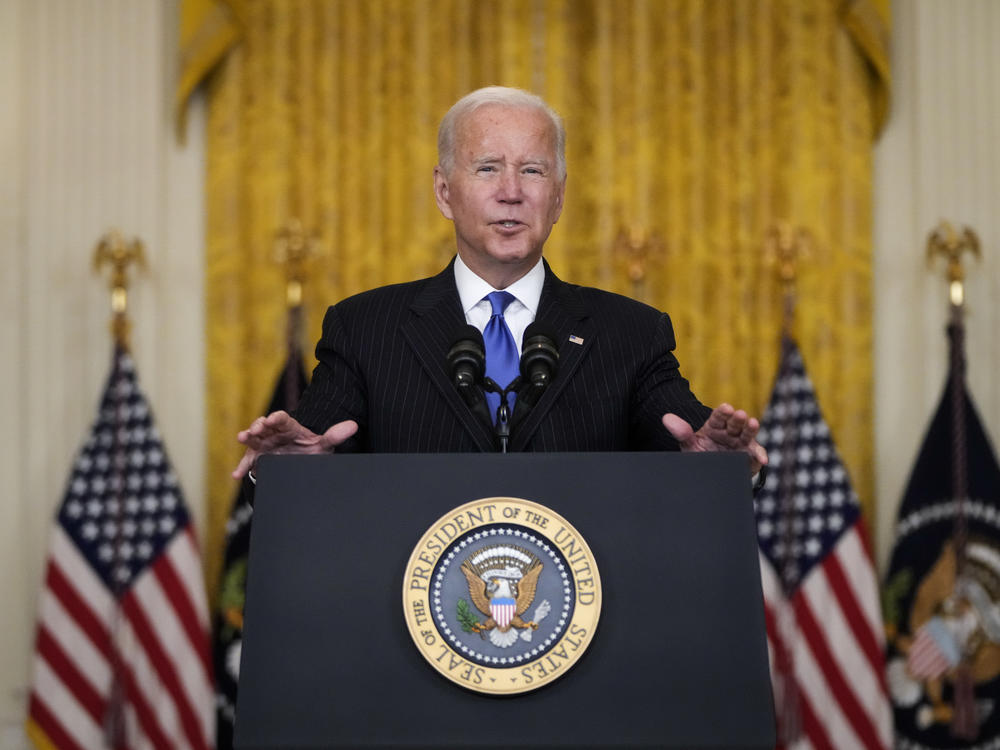

Why is the Biden administration increasing the cost of building houses?

Primary Content

The average American home is now more expensive than it's ever been. For homeowners, that's probably great news. For renters and would-be homebuyers, it's a calamity. A big part of the reason for surging prices is a lack of new housing supply. And to build new houses, you need lumber.

With surging demand and lackluster supply, lumber has gotten absurdly expensive during the coronavirus pandemic. At its height, in May, the price of lumber futures hit more than $1,600 per thousand board feet, more than four times what it averaged in the five years before 2020. In April, the National Association of Home Builders (NAHB) estimated that increased lumber prices added almost $36,000 to the average price of a single-family home.

The price of lumber dipped this summer as production picked back up from its early-pandemic slump and cash-conscious DIYers and other woodworkers decided to delay their projects. But lumber prices have remained abnormally high, and they're now surging again. It's a big headache for homebuilders and a roadblock to making housing more affordable.

The White House has declared that "President Biden is committed to using every tool available in government to produce more affordable housing supply as quickly as possible." Yet on Nov. 24, Biden's Commerce Department announced it was doubling duties on softwood lumber imported from Canada, from an average of 8.99% to 17.9%. Softwood lumber is a crucial material needed to build houses, and levying a large tax on imports only hurts the cause of expanding housing supply.

The NAHB — which represents homebuilders, which, naturally, have an interest in low lumber prices — is unhappy with Biden's policy. "With the nation in the midst of a housing affordability crisis, the Biden administration has moved to slap a huge, unwanted tax hike on American home buyers and renters," said NAHB Chairman Chuck Fowke in a statement. "This is the worst time to add needless housing costs onto the backs of hardworking American families."

This policy may be a large tax on foreign imports that increases the price of lumber, but the Biden administration stresses these aren't tariffs. Technically, they're doubling "antidumping and countervailing duties" on lumber imported from various Canadian provinces, and the administration claims it's doing this in the name of fairness, not crude protectionism.

"The United States' antidumping and countervailing duty (AD/CVD) laws provide U.S. businesses and workers with a transparent and internationally-accepted mechanism to seek relief from the market-distorting effects caused by unfair pricing or subsidization from a foreign trading partner," says a Commerce Department spokesperson. "AD/CVD laws are fundamentally important to a healthy global economy because they are designed to remedy the amount of unfair dumping and/or subsidization by a foreign country."

The most vocal group in favor of this tax on Canadian lumber is the U.S. Lumber Coalition. If you're being generous, you'd say it has the backs of American lumber companies and workers. If you're being cynical, you'd say it has a vested interest in reducing competition and increasing the price of wood it sells to American consumers and homebuilders.

"The U.S. Lumber Coalition thanks the Commerce Department for their hard work and continued commitment to strongly enforce the U.S. trade laws against unfairly traded Canadian lumber imports," said U.S. Lumber Coalition Chairman Jason Brochu in a statement.

The U.S. Lumber Coalition and its allies have alleged for decades that Canada unfairly subsidizes lumber production. Their core argument is that Canadian provinces charge below-market rates for lumber companies to harvest trees on public lands, constituting an anti-competitive subsidy that gives Canadian lumber companies an unfair advantage over U.S. lumber companies. The Biden administration agrees that's the case.

However, the World Trade Organization (WTO) and various other trade bodies have investigated this claim multiple times, and most times they've ruled in Canada's favor. In 2006, after both WTO and NAFTA panels ruled in favor of Canada, George W. Bush's administration agreed to pay back billions of dollars that the U.S. government had collected from duties on Canadian lumber. The U.S. and Canada signed a deal to stop fussing over the issue for a while.

After the U.S.-Canada pact expired, the Trump administration, in 2017, imposed 20% duties on Canadian softwood lumber producers. The administration was given cover to do this by the U.S. International Trade Commission, which ruled that U.S. lumber companies were "materially injured" by Canadian lumber that was sold in the U.S. at "less than fair value." Canada has continually rejected this claim, insisting it does not subsidize its lumber producers.

In August 2020, a three-person panel at the WTO found that the U.S. government erred in imposing these duties, failing to show that Canadian lumber companies were paying artificially low rates to cut trees on public lands. The Trump administration was not happy with this ruling and vowed to fight it. But in December 2020, with lumber prices going bananas during the pandemic, the Trump administration decided to slash duties on Canadian lumber from 20% to 9%.

Reacting to the Biden administration's recent decision to hike lumber duties again, Canada's international trade minister, Mary Ng, expressed frustration. "At every step of the way, rulings have found Canada to be a fair trading partner," Ng said in a statement. "These unjustified duties harm Canadian communities, businesses, and workers. They are also a tax on U.S. consumers, raising the costs of housing, renovations, and rentals at a time when housing affordability is already a significant concern for many."

Biden's Trumpesque trade policies

Despite having campaigned against Donald Trump's trade policies, Biden has largely continued in his predecessor's protectionist footsteps — not just with Canadian lumber, but with many products from China and a host of other nations. Now with rising concerns about inflation, many economists and business leaders are arguing that an effective way to combat spiking prices is to cut these tariffs, which amount to a gigantic tax — as high as $51 billion a year — on American consumers and businesses that rely on imports.

Interestingly, Treasury Secretary Janet Yellen, a respected economist in her own right, made this argument herself recently. Speaking with Reuters, she said that tariffs tend to increase prices for consumers and businesses. Lowering tariffs, she said, would have a "disinflationary" effect.

Last month, two dozen business groups wrote an open letter to Yellen and U.S. Trade Representative Katherine Tai, urging the Biden administration to cut tariffs on Chinese imports as a way to combat inflation. The letter cited the recent anti-tariff comments made by Yellen, and it urged the administration to put its money where its mouth is.

"We agree with Secretary Yellen's recent comments that tariffs tend to increase domestic prices and raise costs to consumers and businesses due to higher cost inputs and that lowering U.S. and Chinese tariffs could help ease inflation," the letter says. "These costs, compounded by other inflationary pressures, impose a significant burden on American businesses, farmers, and families trying to recover from the effects of the pandemic."

Biden may be hurting the cause of affordable housing by increasing the cost of lumber. But, to be fair to him, Biden is currently fighting for the Build Back Better plan, which includes a proposal to spend $170 billion on affordable housing. That said, even this ambitious proposal is being criticized for not doing enough to expand housing supply, which is crucial to bringing prices down.

Copyright 2021 NPR. To see more, visit https://www.npr.org.

Bottom Content